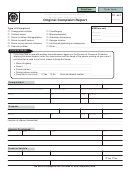

Michigan Department of Treasury

This form is issued under authority of P.A. 167 of 1933.

2189 (Rev. 04-13)

Filing is voluntary but must be filed for claim to be allowed.

Fuel Retailer Supplemental Report

1. Account Number:

2. Return Period: Month(s)

Year

3. Registered Owner’s Name

4. Total Amount Due. Enter amount from Combined Return for Michigan Taxes (Form 160)

Total Payment line, or Discount Voucher for Sales and Use Taxes (Form 161), Total Payment line .................4.

Gallons

Prepaid Tax

5.

a. Enter gallons and prepaid sales tax on gasoline for the period

__________

$___________

b. Enter gallons and prepaid sales tax on diesel fuel for the period __________

$___________

5c.

Enter total prepaid sales tax for the period. Add lines 5a and 5b prepaid tax amounts ..

c.

6. Sales tax collection discount. Enter 2/3 (.6667) of line 5 (See instructions.) ................

6.

7. Add sales tax prepaid (line 5) and discount (line 6) .......................................................... 7.

8. Net Amount Due. Subtract line 7 from line 4.

(If credit, use against your next return.) ..............................................................................................................8.

Complete reverse side. Attach this form to your Form 160 or Form 161. If no return is required, mail this form and a letter requesting a refund to

Michigan Department of Treasury, P.O. Box 30427, Lansing, MI 48909. For questions, call (517) 636-6925.

Michigan Department of Treasury

This form is issued under authority of P.A. 167 of 1933.

2189 (Rev. 04-13)

Filing is voluntary but must be filed for claim to be allowed.

Fuel Retailer Supplemental Report

1. Account Number:

2. Return Period: Month(s)

Year

3. Registered Owner’s Name

4. Total Amount Due. Enter amount from Combined Return for Michigan Taxes (Form 160)

Total Payment line, or Discount Voucher for Sales and Use Taxes (Form 161), Total Payment line .................4.

Gallons

Prepaid Tax

5.

a. Enter gallons and prepaid sales tax on gasoline for the period

__________

$___________

b. Enter gallons and prepaid sales tax on diesel fuel for the period __________

$___________

5c.

Enter total prepaid sales tax for the period. Add lines 5a and 5b prepaid tax amounts ..

c.

6. Sales tax collection discount. Enter 2/3 (.6667) of line 5 (See instructions.) ................

6.

7. Add sales tax prepaid (line 5) and discount (line 6) .......................................................... 7.

8. Net Amount Due. Subtract line 7 from line 4.

(If credit, use against your next return.) ..............................................................................................................8.

Complete reverse side. Attach this form to your Form 160 or Form 161. If no return is required, mail this form and a letter requesting a refund to

Michigan Department of Treasury, P.O. Box 30427, Lansing, MI 48909. For questions, call (517) 636-6925.

Michigan Department of Treasury

This form is issued under authority of P.A. 167 of 1933.

2189 (Rev. 04-13)

Filing is voluntary but must be filed for claim to be allowed.

Fuel Retailer Supplemental Report

1. Account Number:

2. Return Period: Month(s)

Year

3. Registered Owner’s Name

4. Total Amount Due. Enter amount from Combined Return for Michigan Taxes (Form 160)

Total Payment line, or Discount Voucher for Sales and Use Taxes (Form 161), Total Payment line .................4.

Gallons

Prepaid Tax

5.

a. Enter gallons and prepaid sales tax on gasoline for the period

__________

$___________

b. Enter gallons and prepaid sales tax on diesel fuel for the period __________

$___________

5c.

Enter total prepaid sales tax for the period. Add lines 5a and 5b prepaid tax amounts ..

c.

6. Sales tax collection discount. Enter 2/3 (.6667) of line 5 (See instructions.) ................

6.

7. Add sales tax prepaid (line 5) and discount (line 6) .......................................................... 7.

8. Net Amount Due. Subtract line 7 from line 4.

(If credit, use against your next return.) ..............................................................................................................8.

Complete reverse side. Attach this form to your Form 160 or Form 161. If no return is required, mail this form and a letter requesting a refund to

Michigan Department of Treasury, P.O. Box 30427, Lansing, MI 48909. For questions, call (517) 636-6925.

1

1 2

2 3

3 4

4