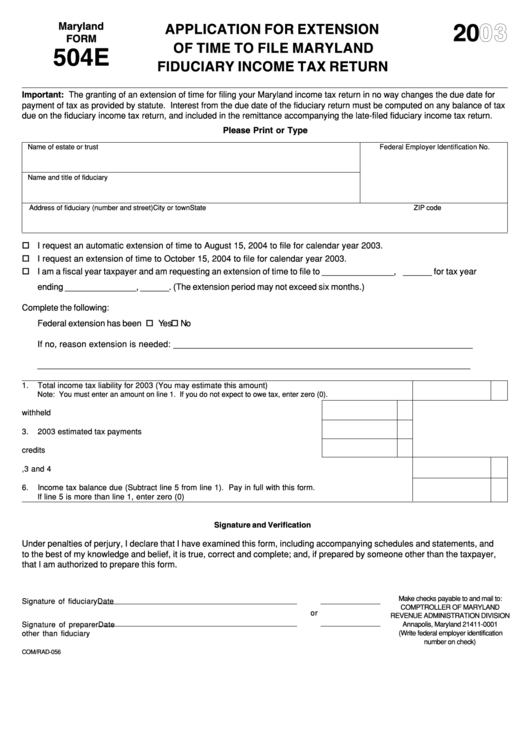

Maryland

2003

APPLICATION FOR EXTENSION

FORM

OF TIME TO FILE MARYLAND

504E

FIDUCIARY INCOME TAX RETURN

Important: The granting of an extension of time for filing your Maryland income tax return in no way changes the due date for

payment of tax as provided by statute. Interest from the due date of the fiduciary return must be computed on any balance of tax

due on the fiduciary income tax return, and included in the remittance accompanying the late-filed fiduciary income tax return.

Please Print or Type

Name of estate or trust

Federal Employer Identification No.

Name and title of fiduciary

Address of fiduciary (number and street)

City or town

State

ZIP code

I request an automatic extension of time to August 15, 2004 to file for calendar year 2003.

I request an extension of time to October 15, 2004 to file for calendar year 2003.

I am a fiscal year taxpayer and am requesting an extension of time to file to _______________, ______ for tax year

ending _______________, ______. (The extension period may not exceed six months.)

Complete the following:

Federal extension has been requested .......................................................................................................

Yes

No

If no, reason extension is needed: _____________________________________________________________

______________________________________________________________________________________________

1.

Total income tax liability for 2003 (You may estimate this amount) ................................................................ 1

Note: You must enter an amount on line 1. If you do not expect to owe tax, enter zero (0).

2.

Maryland income tax withheld ............................................................................. 2

3.

2003 estimated tax payments .............................................................................. 3

4.

Other payments and credits ................................................................................ 4

5.

Add lines 2, 3 and 4 ........................................................................................................................................ 5

6.

Income tax balance due (Subtract line 5 from line 1). Pay in full with this form.

If line 5 is more than line 1, enter zero (0) ..................................................................................................... 6

Signature and Verification

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and

to the best of my knowledge and belief, it is true, correct and complete; and, if prepared by someone other than the taxpayer,

that I am authorized to prepare this form.

Make checks payable to and mail to:

Signature of fiduciary

Date

COMPTROLLER OF MARYLAND

or

REVENUE ADMINISTRATION DIVISION

Signature of preparer

Date

Annapolis, Maryland 21411-0001

other than fiduciary

(Write federal employer identification

number on check)

COM/RAD-056

1

1