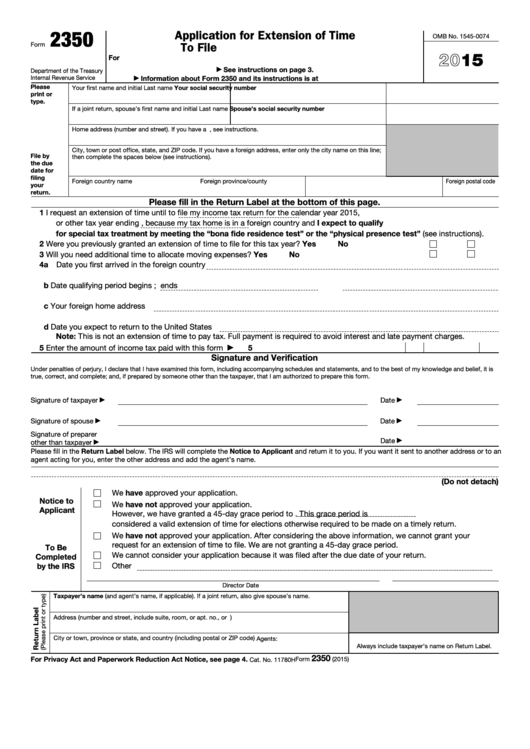

2350

Application for Extension of Time

OMB No. 1545-0074

To File U.S. Income Tax Return

Form

2015

For U.S. Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment

See instructions on page 3.

Department of the Treasury

▶

Internal Revenue Service

Information about Form 2350 and its instructions is at

▶

Please

Your first name and initial

Last name

Your social security number

print or

type.

If a joint return, spouse’s first name and initial

Last name

Spouse’s social security number

Home address (number and street). If you have a P.O. box, see instructions.

City, town or post office, state, and ZIP code. If you have a foreign address, enter only the city name on this line;

File by

then complete the spaces below (see instructions).

the due

date for

filing

Foreign country name

Foreign province/county

Foreign postal code

your

return.

Please fill in the Return Label at the bottom of this page.

1

I request an extension of time until

to file my income tax return for the calendar year 2015,

or other tax year ending

, because my tax home is in a foreign country and I expect to qualify

for special tax treatment by meeting the “bona fide residence test” or the “physical presence test” (see instructions).

2

Yes

No

Were you previously granted an extension of time to file for this tax year? .

.

.

.

.

.

.

.

.

.

.

3

Yes

No

Will you need additional time to allocate moving expenses? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4a Date you first arrived in the foreign country

b Date qualifying period begins

; ends

c Your foreign home address

d Date you expect to return to the United States

Note: This is not an extension of time to pay tax. Full payment is required to avoid interest and late payment charges.

5

Enter the amount of income tax paid with this form .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

▶

Signature and Verification

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete; and, if prepared by someone other than the taxpayer, that I am authorized to prepare this form.

Signature of taxpayer

Date

▶

▶

Signature of spouse

Date

▶

▶

Signature of preparer

Date

▶

other than taxpayer

▶

Please fill in the Return Label below. The IRS will complete the Notice to Applicant and return it to you. If you want it sent to another address or to an

agent acting for you, enter the other address and add the agent’s name.

(Do not detach)

We have approved your application.

Notice to

We have not approved your application.

Applicant

However, we have granted a 45-day grace period to

. This grace period is

considered a valid extension of time for elections otherwise required to be made on a timely return.

We have not approved your application. After considering the above information, we cannot grant your

request for an extension of time to file. We are not granting a 45-day grace period.

To Be

We cannot consider your application because it was filed after the due date of your return.

Completed

Other

by the IRS

Director

Date

Taxpayer’s name (and agent’s name, if applicable). If a joint return, also give spouse’s name.

Address (number and street, include suite, room, or apt. no., or P.O. box number)

City or town, province or state, and country (including postal or ZIP code)

Agents:

Always include taxpayer’s name on Return Label.

2350

For Privacy Act and Paperwork Reduction Act Notice, see page 4.

Form

(2015)

Cat. No. 11780H

1

1 2

2 3

3 4

4