Form I-8 Long - Cleveland Heights Individual Income Tax Return - 2004

ADVERTISEMENT

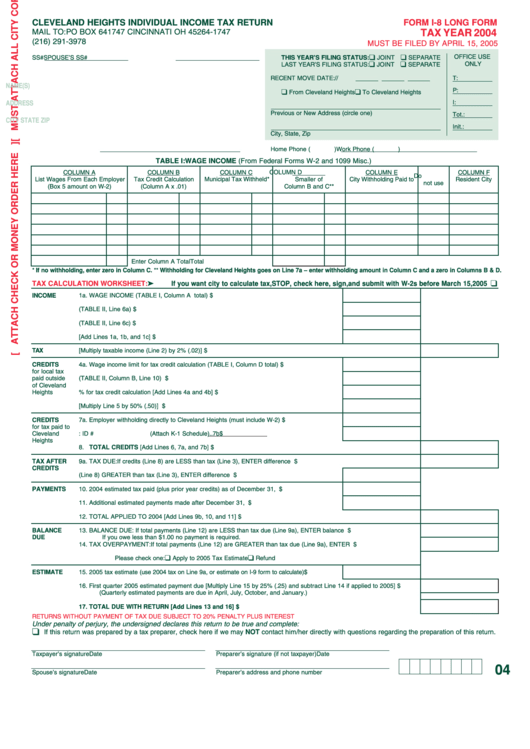

CLEVELAND HEIGHTS INDIVIDUAL INCOME TAX RETURN

FORM I-8 LONG FORM

MAIL TO: PO BOX 641747 CINCINNATI OH 45264-1747

TAX YEAR 2004

(216) 291-3978

MUST BE FILED BY APRIL 15, 2005

❑

❑

OFFICE USE

SS#

SPOUSE’S SS#

THIS YEAR’S FILING STATUS:

JOINT

SEPARATE

❑

❑

ONLY

LAST YEAR’S FILING STATUS:

JOINT

SEPARATE

T:

RECENT MOVE DATE:

/

/

NAME(S)

❑

❑

P:

From Cleveland Heights

To Cleveland Heights

ADDRESS

I:

Previous or New Address (circle one)

Tot.:

CITY STATE ZIP

Init.:

City, State, Zip

Work Phone (

)

Home Phone (

)

TABLE I: WAGE INCOME (From Federal Forms W-2 and 1099 Misc.)

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN E

COLUMN F

Do

List Wages From Each Employer

Tax Credit Calculation

Municipal Tax Withheld*

Smaller of

City Withholding Paid to

Resident City

not use

(Box 5 amount on W-2)

(Column A x .01)

Column B and C**

Enter Column A Total

Total

* If no withholding, enter zero in Column C. ** Withholding for Cleveland Heights goes on Line 7a – enter withholding amount in Column C and a zero in Columns B & D.

❑

➤ If you want city to calculate tax, STOP, check here, sign, and submit with W-2s before March 15, 2005

TAX CALCULATION WORKSHEET:

INCOME

1a. WAGE INCOME (TABLE I, Column A total)..........................................................................1a

$

1b. NON-WAGE INCOME earned in Cleveland Heights (TABLE II, Line 6a) ..............................1b

$

1c. NON-WAGE INCOME earned outside Cleveland Heights (TABLE II, Line 6c)......................1c

$

2. TOTAL TAXABLE INCOME [Add Lines 1a, 1b, and 1c] ..........................................................2

$

TAX

3. TAX [Multiply taxable income (Line 2) by 2% (.02)]................................................................................................................3

$

CREDITS

4a. Wage income limit for tax credit calculation (TABLE I, Column D total) ................................4a

$

for local tax

paid outside

4b. Non-wage income limit for tax credit calculation (TABLE II, Column B, Line 10) ..................4b

$

of Cleveland

Heights

5. Total income limit of 1% for tax credit calculation [Add Lines 4a and 4b]................................5

$

6. TAX CREDIT [Multiply Line 5 by 50% (.50)] ............................................................................6

$

CREDITS

7a. Employer withholding directly to Cleveland Heights (must include W-2) ..............................7a

$

for tax paid to

Cleveland

7b. Your share of business partnership tax: ID #

(Attach K-1 Schedule)..7b

$

Heights

8. TOTAL CREDITS [Add Lines 6, 7a, and 7b] ..........................................................................................................................8

$

TAX AFTER

9a. TAX DUE: If credits (Line 8) are LESS than tax (Line 3), ENTER difference here ..............................................................9a

$

CREDITS

9b. If credits (Line 8) GREATER than tax (Line 3), ENTER difference here................................9b

$

PAYMENTS

10. 2004 estimated tax paid (plus prior year credits) as of December 31, 2004 ........................10

$

11. Additional estimated payments made after December 31, 2004 ..........................................11

$

12. TOTAL APPLIED TO 2004 [Add Lines 9b, 10, and 11] ........................................................................................................12

$

BALANCE

13. BALANCE DUE: If total payments (Line 12) are LESS than tax due (Line 9a), ENTER balance due ................................13

$

DUE

If you owe less than $1.00 no payment is required.

14. TAX OVERPAYMENT: If total payments (Line 12) are GREATER than tax due (Line 9a), ENTER overpayment ..............14

$

❑

❑

Please check one:

Apply to 2005 Tax Estimate

Refund

ESTIMATE

15. 2005 tax estimate (use 2004 tax on Line 9a, or estimate on I-9 form to calculate) ................15

$

16. First quarter 2005 estimated payment due [Multiply Line 15 by 25% (.25) and subtract Line 14 if applied to 2005]..........16

$

(Quarterly estimated payments are due in April, July, October, and January.)

17. TOTAL DUE WITH RETURN [Add Lines 13 and 16] ........................................................................................................17

$

RETURNS WITHOUT PAYMENT OF TAX DUE SUBJECT TO 20% PENALTY PLUS INTEREST

Under penalty of perjury, the undersigned declares this return to be true and complete:

❑

If this return was prepared by a tax preparer, check here if we may NOT contact him/her directly with questions regarding the preparation of this return.

Taxpayer’s signature

Date

Preparer’s signature (if not taxpayer)

Date

04

Spouse’s signature

Date

Preparer’s address and phone number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2