4

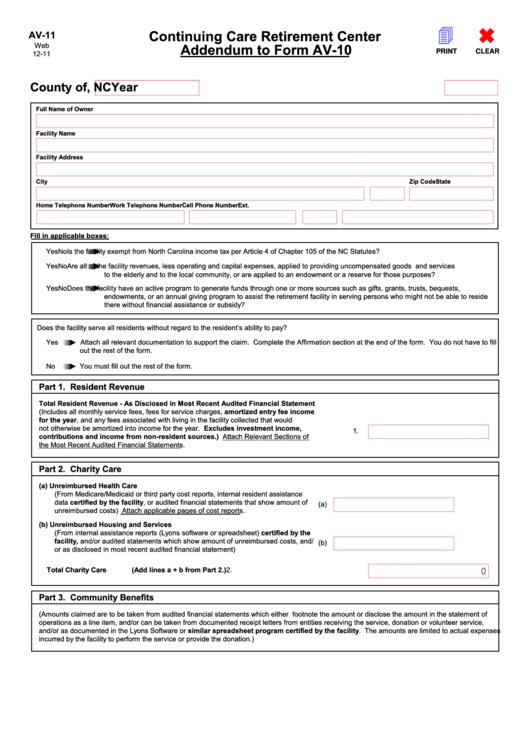

Continuing Care Retirement Center

AV-11

Web

Addendum to Form AV-10

PRINT

CLEAR

12-11

County of

, NC

Year

Full Name of Owner

Facility Name

Facility Address

City

State

Zip Code

Home Telephone Number

Work Telephone Number

Ext.

Cell Phone Number

Fill in applicable boxes:

►

Yes

No

Is the facility exempt from North Carolina income tax per Article 4 of Chapter 105 of the NC Statutes?

►

Yes

No

Are all of the facility revenues, less operating and capital expenses, applied to providing uncompensated goods and services

to the elderly and to the local community, or are applied to an endowment or a reserve for those purposes?

►

Yes

No

Does the facility have an active program to generate funds through one or more sources such as gifts, grants, trusts, bequests,

endowments, or an annual giving program to assist the retirement facility in serving persons who might not be able to reside

there without financial assistance or subsidy?

Does the facility serve all residents without regard to the resident’s ability to pay?

►

Yes

Attach all relevant documentation to support the claim. Complete the Affirmation section at the end of the form. You do not have to fill

out the rest of the form.

►

No

You must fill out the rest of the form.

Part 1. Resident Revenue

Total Resident Revenue - As Disclosed in Most Recent Audited Financial Statement

(Includes all monthly service fees, fees for service charges, amortized entry fee income

for the year, and any fees associated with living in the facility collected that would

not otherwise be amortized into income for the year. Excludes investment income,

1.

contributions and income from non-resident sources.) Attach Relevant Sections of

the Most Recent Audited Financial Statements.

Part 2. Charity Care

(a) Unreimbursed Health Care

(From Medicare/Medicaid or third party cost reports, internal resident assistance

data certified by the facility, or audited financial statements that show amount of

(a)

unreimbursed costs) Attach applicable pages of cost reports.

(b) Unreimbursed Housing and Services

(From internal assistance reports (Lyons software or spreadsheet) certified by the

facility, and/or audited statements which show amount of unreimbursed costs, and/

(b)

or as disclosed in most recent audited financial statement)

Total Charity Care

(Add lines a + b from Part 2.)

2.

0

Part 3. Community Benefits

(Amounts claimed are to be taken from audited financial statements which either footnote the amount or disclose the amount in the statement of

operations as a line item, and/or can be taken from documented receipt letters from entities receiving the service, donation or volunteer service,

and/or as documented in the Lyons Software or similar spreadsheet program certified by the facility. The amounts are limited to actual expenses

incurred by the facility to perform the service or provide the donation.)

1

1 2

2