10

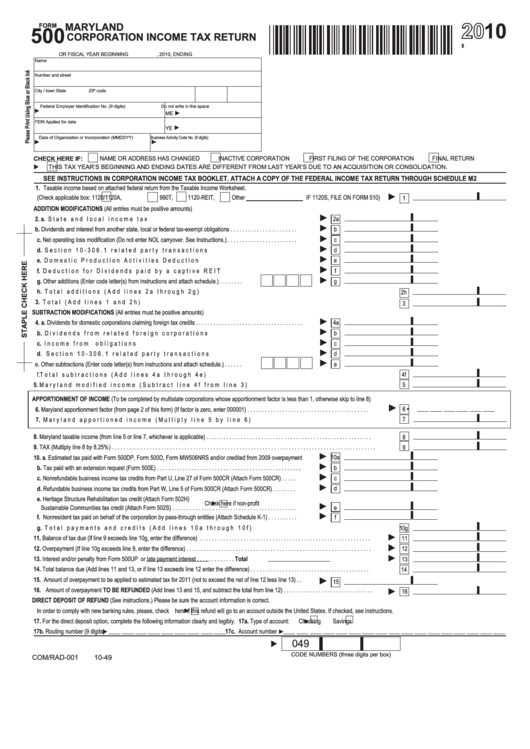

MARYLAND

FORM

500

CORPORATION INCOME TAX RETURN

$

OR FISCAL YEAR BEGINNING , 2010, ENDING

105000049

Name

Number and street

City / town

State

ZIP code

Federal Employer Identification No. (9 digits)

Do not write in this space

ME

FEIN Applied for date

YE

Business Activity Code No. (6 digits)

Date of Organization or Incorporation (MMDDYY)

CHECK HERE IF:

NAME OR ADDRESS HAS CHANGED

INACTIVE CORPORATION

FIRST FILING OF THE CORPORATION

FINAL RETURN

THIS TAX YEAR’S BEGINNING AND ENDING DATES ARE DIFFERENT FROM LAST YEAR’S DUE TO AN ACQUISITION OR CONSOLIDATION.

SEE INSTRUCTIONS IN CORPORATION INCOME TAX BOOKLET. ATTACH A COPY OF THE FEDERAL INCOME TAX RETURN THROUGH SCHEDULE M2

1. Taxable income based on attached federal return from the Taxable Income Worksheet.

▌

(Check applicable box:

1120/1120A,

1120-REIT,

Other

IF 1120S, FILE ON FORM 510)

990T,

1

A DDITION MODIFICATIONS (All entries must be positive amounts)

▌

2. a. State and local income tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2a

▌

b. Dividends and interest from another state, local or federal tax-exempt obligations . . . . . . . . . . . . . . . . . . . . . . .

b

▌

c. Net operating loss modification (Do not enter NOL carryover. See Instructions.) . . . . . . . . . . . . . . . . . . . . . . . .

c

▌

d. Section 10-306.1 related party transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d

▌

e. Domestic Production Activities Deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e

▌

f. Deduction for Dividends paid by a captive REIT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

f

▌

g. Other additions (Enter code letter(s) from instructions and attach schedule.) . . . . . . . .

g

▌

h. Total additions (Add lines 2a through 2g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2h

▌

3. Total (Add lines 1 and 2h) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

SUBTRACTION MODIFICATIONS (All entries must be positive amounts)

▌

4. a. Dividends for domestic corporations claiming foreign tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4a

▌

b. Dividends from related foreign corporations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b

▌

c. Income from U.S. obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c

▌

d. Section 10-306.1 related party transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d

▌

e. Other subtractions (Enter code letter(s) from instructions and attach schedule.) . . . . . .

e

▌

4f

f. Total subtractions (Add lines 4a through 4e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

▌

5

5. Maryland modified income (Subtract line 4f from line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

APPORTIONMENT OF INCOME (To be completed by multistate corporations whose apportionment factor is less than 1, otherwise skip to line 8)

6. Maryland apportionment factor (from page 2 of this form) (If factor is zero, enter 000001) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

•

▌

7. Maryland apportioned income (Multiply line 5 by line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

▌

8. Maryland taxable income (from line 5 or line 7, whichever is applicable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

▌

9. TAX (Multiply line 8 by 8.25%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

▌

10. a. Estimated tax paid with Form 500DP, Form 500D, Form MW506NRS and/or credited from 2009 overpayment

10a

▌

b. Tax paid with an extension request (Form 500E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b

▌

c. Nonrefundable business income tax credits from Part U, Line 27 of Form 500CR (Attach Form 500CR) . . . . .

c

▌

d. Refundable business income tax credits from Part W, Line 5 of Form 500CR (Attach Form 500CR) . . . . . . . .

d

e. Heritage Structure Rehabilitation tax credit (Attach Form 502H)

Check here if non-profit

▌

Sustainable Communities tax credit (Attach Form 502S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e

▌

f. Nonresident tax paid on behalf of the corporation by pass-through entities (Attach Schedule K-1) . . . . . . . . . .

f

▌

g. Total payments and credits (Add lines 10a through 10f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10g

▌

11. Balance of tax due (If line 9 exceeds line 10g, enter the difference) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

▌

1 2. Overpayment (If line 10g exceeds line 9, enter the difference) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

▌

1 3. Interest and/or penalty from Form 500UP

or late payment interest

. . . . . . . . . . . . . Total

13

▌

1 4. Total balance due (Add lines 11 and 13, or if line 13 exceeds line 12 enter the difference) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

1 5. A mount of overpayment to be applied to estimated tax for 2011 (not to exceed the net of line 12 less line 13) . .

▌

15

1 6. A mount of overpayment TO BE REFUNDED (Add lines 13 and 15, and subtract the total from line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

▌

16

DIRECT DEPOSIT OF REFUND (See instructions.) Please be sure the account information is correct.

In order to comply with new banking rules, please, check

here if this refund will go to an account outside the United States. If checked, see instructions.

17. For the direct deposit option, complete the following information clearly and legibly. 17a. Type of account:

Checking

Savings

1 7b. Routing number (9 digits)

17c. Account number

049

CODE NUMBERS (three digits per box)

COM/RAD-001

10-49

1

1 2

2