Form Rcyl-Ct - Recycle Credit/deduction (2002)

ADVERTISEMENT

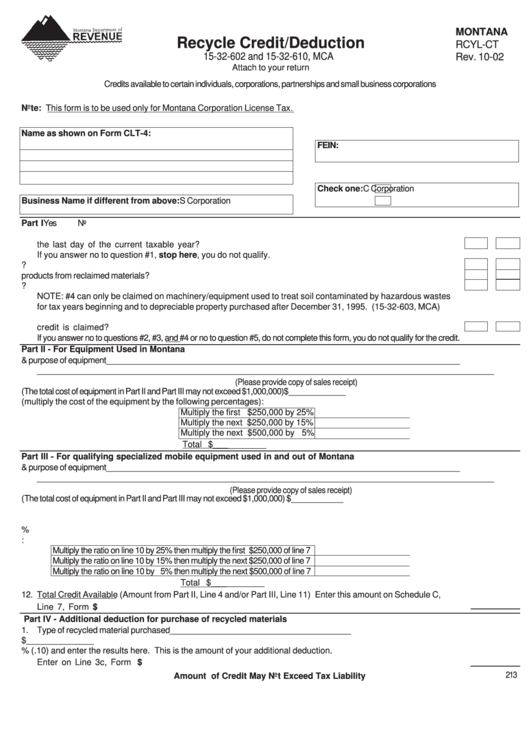

MONTANA

Recycle Credit/Deduction

RCYL-CT

15-32-602 and 15-32-610, MCA

Rev. 10-02

Attach to your return

Credits available to certain individuals, corporations, partnerships and small business corporations

Note: This form is to be used only for Montana Corporation License Tax.

Name as shown on Form CLT-4:

FEIN:

Check one:

C Corporation

Business Name if different from above:

S Corporation

Part I

Yes

No

1. Was the qualifying machinery/equipment purchased on or after the first day of the current taxable year and before

the last day of the current taxable year?...........................................................................................................

If you answer no to question #1, stop here, you do not qualify.

2. Is the machinery/equipment used in Montana primarily for collecting or processing reclaimable material?.............

3. Is the machinery/equipment used in Montana primarily to manufacture finished products from reclaimed materials?

4. Is the machinery/equipment used to treat soil contaminated by hazardous wastes?..............................................

NOTE: #4 can only be claimed on machinery/equipment used to treat soil contaminated by hazardous wastes

for tax years beginning and to depreciable property purchased after December 31, 1995. (15-32-603, MCA)

5. Was the machinery/equipment located and operating in Montana on the last day of the taxable year for which the

credit is claimed?...........................................................................................................................................

If you answer no to questions #2, #3, and #4 or no to question #5, do not complete this form, you do not qualify for the credit.

Part II - For Equipment Used in Montana

1. Type & purpose of equipment______________________________________________________________________________

______________________________________________________________________________________________________

2. Date of Purchase___________________________

(Please provide copy of sales receipt)

3. Cost of Equipment (The total cost of equipment in Part II and Part III may not exceed $1,000,000)..............$____________

4. Computation of Credit (multiply the cost of the equipment by the following percentages):

Multiply the first $250,000 by 25%

Multiply the next $250,000 by 15%

Multiply the next $500,000 by 5%

Total Credit......................................................................................$___________

Part III - For qualifying specialized mobile equipment used in and out of Montana

5. Type & purpose of equipment______________________________________________________________________________

______________________________________________________________________________________________________

6. Date of Purchase___________________________

(Please provide copy of sales receipt)

7. Cost of Equipment (The total cost of equipment in Part II and Part III may not exceed $1,000,000)................$___________

8. Number of days used in Montana ______________________________________________________

9. Total days used for the year___________________________________________________________

10. Divide amount on Line 8 by amount on Line 9.____________________________________________%

11. Computation of Credit:

Multiply the ratio on line 10 by 25% then multiply the first $250,000 of line 7

Multiply the ratio on line 10 by 15% then multiply the next $250,000 of line 7

Multiply the ratio on line 10 by 5% then multiply the next $500,000 of line 7

Total Credit.......................................................................................$___________

12. Total Credit Available (Amount from Part II, Line 4 and/or Part III, Line 11) Enter this amount on Schedule C,

Line 7, Form CLT-4..........................................................................................................................................$

Part IV - Additional deduction for purchase of recycled materials

1. Type of recycled material purchased_______________________________________

2. Cost of recycled material............................................................................................................$______________

3. Multiply the amount on line 2 by 10% (.10) and enter the results here. This is the amount of your additional deduction.

Enter on Line 3c, Form CLT-4...........................................................................................................................$

213

Amount of Credit May Not Exceed Tax Liability

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1