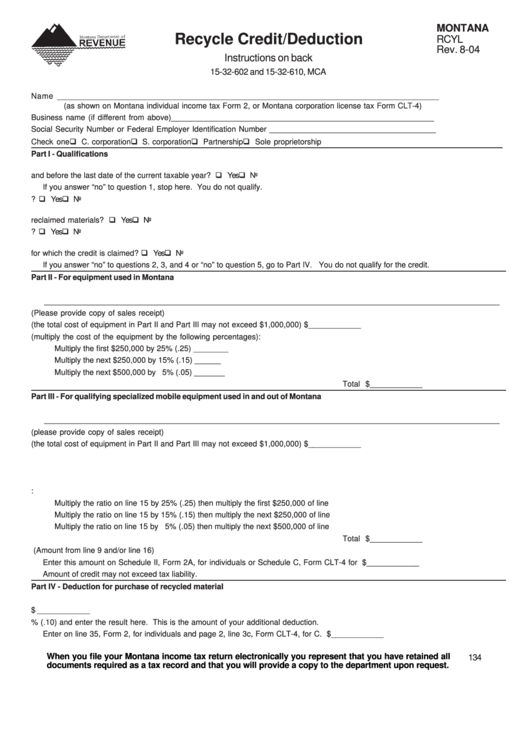

MONTANA

Recycle Credit/Deduction

RCYL

Rev. 8-04

Instructions on back

15-32-602 and 15-32-610, MCA

Name _______________________________________________________________________________________

(as shown on Montana individual income tax Form 2, or Montana corporation license tax Form CLT-4)

Business name (if different from above) ____________________________________________________________

Social Security Number or Federal Employer Identification Number ______________________________________

Check one

C. corporation

S. corporation

Partnership

Sole proprietorship

Part I - Qualifications

1. Was the qualifying machinery/equipment purchased on or after the first day of the current taxable year

and before the last date of the current taxable year? .................................................................................................

Yes

No

If you answer “no” to question 1, stop here. You do not qualify.

2. Is the machinery/equipment used in Montana primarily for collections or processing reclaimed material? ..........

Yes

No

3. Is the machinery/equipment used in Montana primarily for the manufacturing of finished products from

reclaimed materials? ..................................................................................................................................................

Yes

No

4. Is the machinery/equipment used to treat soils contaminated by hazardous wastes? ...........................................

Yes

No

5. Was the machinery/equipment located and operating in Montana on the last day of the taxable year

for which the credit is claimed? ..................................................................................................................................

Yes

No

If you answer “no” to questions 2, 3, and 4 or “no” to question 5, go to Part IV. You do not qualify for the credit.

Part II - For equipment used in Montana

6. Type and purpose of equipment ______________________________________________________________________________

________________________________________________________________________________________________________

7. Date of purchase ________________________________ (Please provide copy of sales receipt)

8. Cost of equipment (the total cost of equipment in Part II and Part III may not exceed $1,000,000) ......................... $ ____________

9. Computation of credit (multiply the cost of the equipment by the following percentages):

Multiply the first $250,000 by 25% (.25) ....................................................................................

___________

Multiply the next $250,000 by 15% (.15) ...................................................................................

___________

Multiply the next $500,000 by 5% (.05) ...................................................................................

___________

Total Credit ...................... $ ____________

Part III - For qualifying specialized mobile equipment used in and out of Montana

10.Type and purpose of equipment ______________________________________________________________________________

________________________________________________________________________________________________________

11. Date of purchase ________________________________ (please provide copy of sales receipt)

12.Cost of equipment (the total cost of equipment in Part II and Part III may not exceed $1,000,000) ......................... $ ____________

13.Number of days used in Montana ...................................

_____________

14.Total days used for the year .............................................

_____________

15.Divide amount on line 13 by amount on Line 14...............

_____________

16.Computation of credit:

Multiply the ratio on line 15 by 25% (.25) then multiply the first $250,000 of line 12 ...............

___________

Multiply the ratio on line 15 by 15% (.15) then multiply the next $250,000 of line 12 ..............

___________

Multiply the ratio on line 15 by 5% (.05) then multiply the next $500,000 of line 12 ...............

___________

Total Credit ...................... $ ____________

17.Total Credit Available (Amount from line 9 and/or line 16)

Enter this amount on Schedule II, Form 2A, for individuals or Schedule C, Form CLT-4 for corporations .............. $ ____________

Amount of credit may not exceed tax liability.

Part IV - Deduction for purchase of recycled material

18.Type of recycled material purchased __________________________________________________________________________

19.Cost of recycled material ........................................................................................................................................... $ ____________

20.Multiply the amount on line 19 by 10% (.10) and enter the result here. This is the amount of your additional deduction.

Enter on line 35, Form 2, for individuals and page 2, line 3c, Form CLT-4, for C. corporations ............................... $ ____________

When you file your Montana income tax return electronically you represent that you have retained all

134

documents required as a tax record and that you will provide a copy to the department upon request.

1

1 2

2