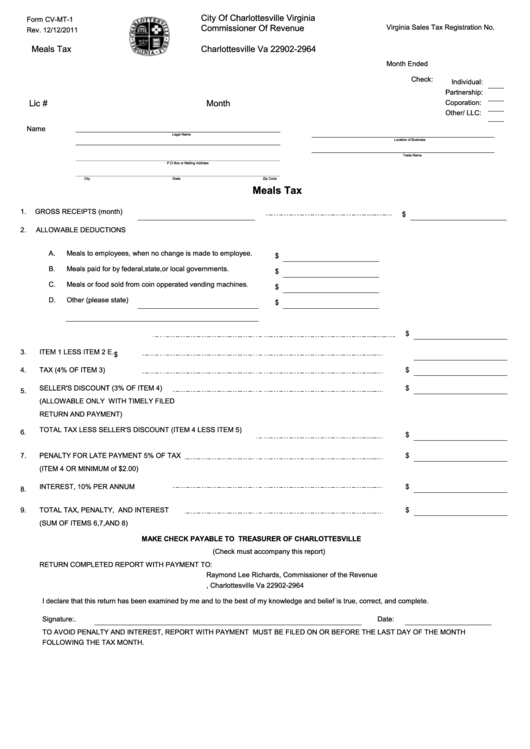

Form Cv-Mt-1 - Meals Tax - City Of Charlottesville Virginia

ADVERTISEMENT

City Of Charlottesville Virginia

Form CV-MT-1

Commissioner Of Revenue

Virginia Sales Tax

Registration No.

Rev. 12/12/2011

P.O. Box 2964

Meals Tax

Charlottesville Va 22902-2964

Month Ended

Check:

Individual:

Partnership:

Lic #

Month

Coporation:

Other/ LLC:

Name

Legal Name

Location of Business

Trade Name

P.O Box or Mailing Address

City

State

Zip Code

Meals Tax

1.

GROSS RECEIPTS (month)

$

2.

ALLOWABLE DEDUCTIONS

A.

Meals to employees, when no change is made to employee.

$

B.

Meals paid for by federal,state,or local governments.

$

C.

Meals or food sold from coin opperated vending machines.

$

D.

Other (please state)

$

E.

Total Deductions

$

3.

ITEM 1 LESS ITEM 2 E.

$

4.

TAX (4% OF ITEM 3)

$

SELLER'S DISCOUNT (3% OF ITEM 4)

$

5.

(ALLOWABLE ONLY WITH TIMELY FILED

RETURN AND PAYMENT)

TOTAL TAX LESS SELLER'S DISCOUNT

(ITEM 4 LESS ITEM 5)

6.

$

7.

PENALTY FOR LATE PAYMENT 5% OF TAX

$

(ITEM 4 OR MINIMUM of $2.00)

INTEREST, 10% PER ANNUM

$

8.

9.

TOTAL TAX, PENALTY, AND INTEREST

$

(SUM OF ITEMS 6,7,AND 8)

MAKE CHECK PAYABLE TO TREASURER OF CHARLOTTESVILLE

(Check must accompany this report)

RETURN COMPLETED REPORT WITH PAYMENT TO:

Raymond Lee Richards, Commissioner of the Revenue

P.O. Box 2964, Charlottesville Va 22902-2964

I declare that this return has been examined by me and to the best of my knowledge and belief is true, correct, and complete.

Signature:.

Date:

TO AVOID PENALTY AND INTEREST, REPORT WITH PAYMENT MUST BE FILED ON OR BEFORE THE LAST DAY OF THE MONTH

FOLLOWING THE TAX MONTH.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1