Form Str - Short Term Rental Tax - City Of Waynesboro, Virginia

ADVERTISEMENT

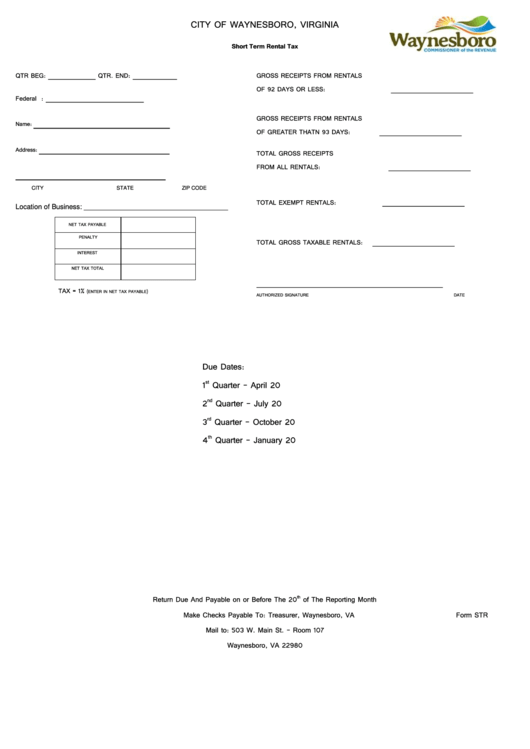

CITY OF WAYNESBORO, VIRGINIA

Short Term Rental Tax

QTR BEG: _______________ QTR. END: ______________

GROSS RECEIPTS FROM RENTALS

OF 92 DAYS OR LESS:

__________________________

Federal I.D. Number: _______________________________

GROSS RECEIPTS FROM RENTALS

______________________________

Name:

OF GREATER THATN 93 DAYS:

__________________________

_____________________________

Address:

TOTAL GROSS RECEIPTS

FROM ALL RENTALS:

__________________________

_________________________________

CITY

STATE

ZIP CODE

TOTAL EXEMPT RENTALS:

__________________________

Location of Business: _____________________________________

NET TAX PAYABLE

PENALTY

TOTAL GROSS TAXABLE RENTALS:

__________________________

INTEREST

NET TAX TOTAL

___________________________________________________________

TAX = 1%

(ENTER IN NET TAX PAYABLE)

AUTHORIZED SIGNATURE

DATE

Due Dates:

1

st

Quarter – April 20

2

nd

Quarter – July 20

3

rd

Quarter – October 20

4

th

Quarter – January 20

Return Due And Payable on or Before The 20

th

of The Reporting Month

Make Checks Payable To: Treasurer, Waynesboro, VA

Form STR

Mail to: 503 W. Main St. – Room 107

Waynesboro, VA 22980

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1