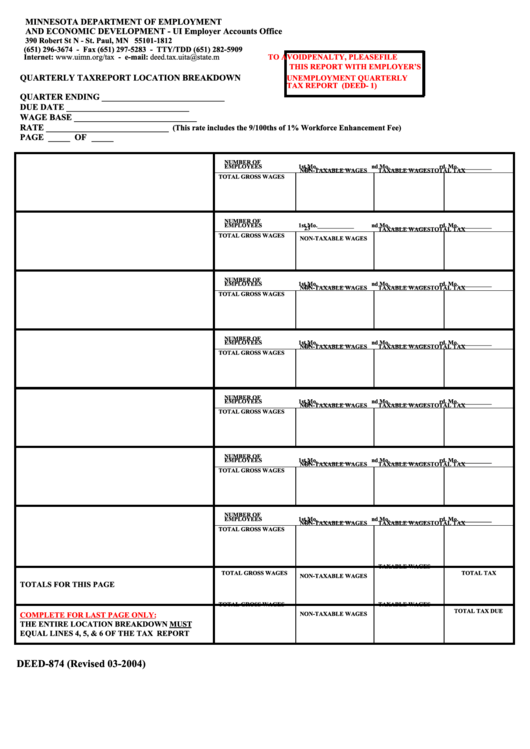

Form Deed-874 - Quarterly Tax Report Location Breakdown

ADVERTISEMENT

MINNESOTA DEPARTMENT OF EMPLOYMENT

AND ECONOMIC DEVELOPMENT - UI Employer Accounts Office

390 Robert St N - St. Paul, MN 55101-1812

(651) 296-3674 - Fax (651) 297-5283 - TTY/TDD (651) 282-5909

Internet: - e-mail: deed.tax.uita@state.mn.us

TO AVOID PENALTY, PLEASE FILE

THIS REPORT WITH EMPLOYER’S

QUARTERLY TAX REPORT LOCATION BREAKDOWN

UNEMPLOYMENT QUARTERLY

TAX REPORT (DEED - 1)

QUARTER ENDING ____________________________

DUE DATE ____________________________

WAGE BASE ____________________________

RATE ____________________________

(This rate includes the 9/100ths of 1% Workforce Enhancement Fee)

PAGE _____ OF _____

NUMBER OF

EMPLOYEES

1st Mo.____________

2

nd Mo.____________

3

rd. Mo.___________

TOTAL GROSS WAGES

NON-TAXABLE WAGES

TAXABLE WAGES

TOTAL TAX

NUMBER OF

EMPLOYEES

1st Mo.____________

2

nd Mo.____________

3

rd. Mo.___________

TOTAL GROSS WAGES

NON-TAXABLE WAGES

TAXABLE WAGES

TOTAL TAX

NUMBER OF

EMPLOYEES

1st Mo.____________

2

nd Mo.____________

3

rd. Mo.___________

TOTAL GROSS WAGES

NON-TAXABLE WAGES

TAXABLE WAGES

TOTAL TAX

NUMBER OF

EMPLOYEES

1st Mo.____________

2

nd Mo.____________

3

rd. Mo.___________

TOTAL GROSS WAGES

NON-TAXABLE WAGES

TAXABLE WAGES

TOTAL TAX

NUMBER OF

EMPLOYEES

1st Mo.____________

2

nd Mo.____________

3

rd. Mo.___________

TOTAL GROSS WAGES

NON-TAXABLE WAGES

TAXABLE WAGES

TOTAL TAX

NUMBER OF

EMPLOYEES

1st Mo.____________

2

nd Mo.____________

3

rd. Mo.___________

TOTAL GROSS WAGES

NON-TAXABLE WAGES

TAXABLE WAGES

TOTAL TAX

NUMBER OF

EMPLOYEES

1st Mo.____________

2

nd Mo.____________

3

rd. Mo.___________

TOTAL GROSS WAGES

NON-TAXABLE WAGES

TAXABLE WAGES

TOTAL TAX

TOTAL GROSS WAGES

NON-TAXABLE WAGES

TAXABLE WAGES

TOTAL TAX

TOTALS FOR THIS PAGE

TOTAL GROSS WAGES

NON-TAXABLE WAGES

TAXABLE WAGES

TOTAL TAX DUE

COMPLETE FOR LAST PAGE ONLY:

THE ENTIRE LOCATION BREAKDOWN MUST

EQUAL LINES 4, 5, & 6 OF THE TAX REPORT

DEED-874 (Revised 03-2004)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1