Form Str 04 - 2004 Sales Tax Remittance Return

ADVERTISEMENT

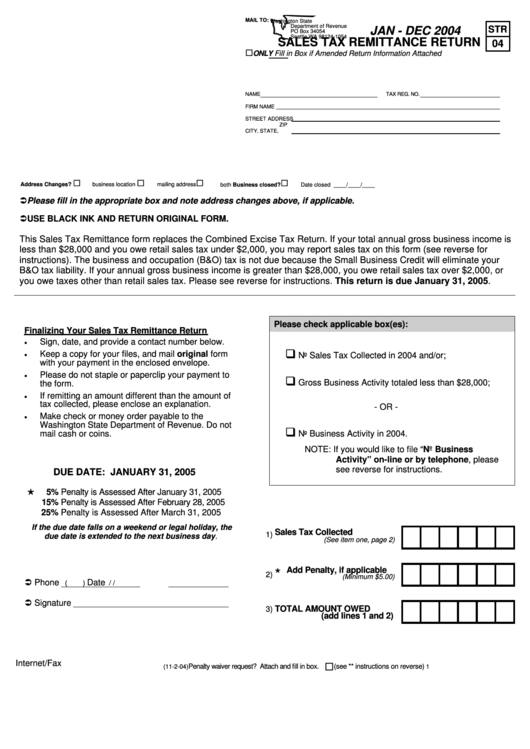

MAIL TO:

Washington State

Department of Revenue

STR

JAN - DEC 2004

PO Box 34054

Seattle WA 98124-1054

04

SALES TAX REMITTANCE RETURN

ONLY Fill in Box if Amended Return Information Attached

NAME

TAX REG. NO.

FIRM NAME

STREET ADDRESS

CITY, STATE, ZIP

Address Changes?

business location

mailing address

both

Business closed?

Date closed ____/____/____

Please fill in the appropriate box and note address changes above, if applicable.

USE BLACK INK AND RETURN ORIGINAL FORM.

This Sales Tax Remittance form replaces the Combined Excise Tax Return. If your total annual gross business income is

less than $28,000 and you owe retail sales tax under $2,000, you may report sales tax on this form (see reverse for

instructions). The business and occupation (B&O) tax is not due because the Small Business Credit will eliminate your

B&O tax liability. If your annual gross business income is greater than $28,000, you owe retail sales tax over $2,000, or

you owe taxes other than retail sales tax. Please see reverse for instructions. This return is due January 31, 2005.

Please check applicable box(es):

Finalizing Your Sales Tax Remittance Return

•

Sign, date, and provide a contact number below.

Keep a copy for your files, and mail original form

•

No Sales Tax Collected in 2004 and/or;

with your payment in the enclosed envelope.

Please do not staple or paperclip your payment to

•

Gross Business Activity totaled less than $28,000;

the form.

•

If remitting an amount different than the amount of

tax collected, please enclose an explanation.

- OR -

•

Make check or money order payable to the

Washington State Department of Revenue. Do not

No Business Activity in 2004.

mail cash or coins.

NOTE: If you would like to file “No Business

Activity” on-line or by telephone, please

see reverse for instructions.

DUE DATE: JANUARY 31, 2005

5% Penalty is Assessed After January 31, 2005

15% Penalty is Assessed After February 28, 2005

25% Penalty is Assessed After March 31, 2005

If the due date falls on a weekend or legal holiday, the

Sales Tax Collected

1)

due date is extended to the next business day.

(See item one, page 2)

Add Penalty, if applicable

2)

(Minimum $5.00)

Phone

Date

(

)

/

/

Signature

TOTAL AMOUNT OWED

3)

(add lines 1 and 2)

Internet/Fax

Penalty waiver request? Attach and fill in box.

(see ** instructions on reverse)

(11-2-04)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4