Sales Tax Remittance Return Form - State Of Washington Department Of Revenue - 2014

ADVERTISEMENT

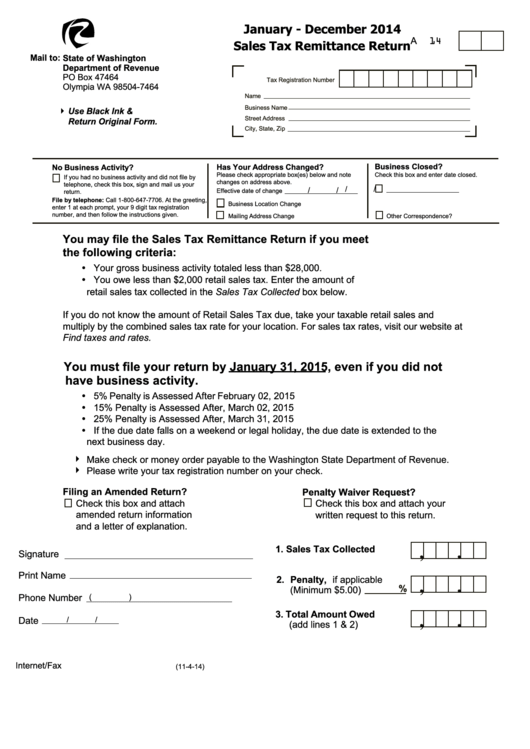

January - December 2014

A

14

Sales Tax Remittance Return

Mail to:

State of Washington

Department of Revenue

PO Box 47464

Tax Registration Number

Olympia WA 98504-7464

Name

Business Name

Use Black Ink &

4

Street Address

Return Original Form.

City, State, Zip

Has Your Address Changed?

Business Closed?

No Business Activity?

Please check appropriate box(es) below and note

Check this box and enter date closed.

If you had no business activity and did not file by

changes on address above.

telephone, check this box, sign and mail us your

/

/

/

/

Effective date of change

return.

File by telephone: Call 1-800-647-7706. At the greeting,

Business Location Change

enter 1 at each prompt, your 9 digit tax registration

number, and then follow the instructions given.

Mailing Address Change

Other Correspondence?

You may file the Sales Tax Remittance Return if you meet

the following criteria:

y Your gross business activity totaled less than $28,000.

y You owe less than $2,000 retail sales tax. Enter the amount of

retail sales tax collected in the Sales Tax Collected box below.

If you do not know the amount of Retail Sales Tax due, take your taxable retail sales and

multiply by the combined sales tax rate for your location. For sales tax rates, visit our website at

dor.wa.gov and click on Find taxes and rates.

You must file your return by January 31, 2015, even if you did not

have business activity.

y 5% Penalty is Assessed After February 02, 2015

y 15% Penalty is Assessed After, March 02, 2015

y 25% Penalty is Assessed After, March 31, 2015

y If the due date falls on a weekend or legal holiday, the due date is extended to the

next business day.

Make check or money order payable to the Washington State Department of Revenue.

4

Please write your tax registration number on your check.

4

Filing an Amended Return?

Penalty Waiver Request?

Check this box and attach

Check this box and attach your

amended return information

written request to this return.

and a letter of explanation.

,

.

1. Sales Tax Collected

Signature

Print Name

2. Penalty, if applicable

,

.

%

(Minimum $5.00)

Phone Number

(

)

3. Total Amount Owed

,

.

Date

/

/

(add lines 1 & 2)

Internet/Fax

(11-4-14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2