Credit For Educational Opportunity Worksheet For Individuals - 2008

ADVERTISEMENT

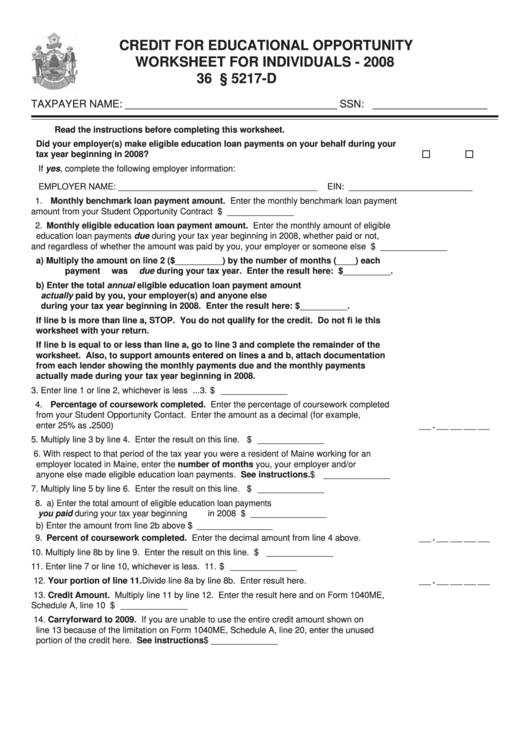

CREDIT FOR EDUCATIONAL OPPORTUNITY

WORKSHEET FOR INDIVIDUALS - 2008

36 M.R.S.A. § 5217-D

TAXPAYER NAME: _____________________________________ SSN: ____________________

Read the instructions before completing this worksheet.

Did your employer(s) make eligible education loan payments on your behalf during your

tax year beginning in 2008? ............................................................................................................

YES

NO

If yes, complete the following employer information:

EMPLOYER NAME: __________________________________________

EIN: __________________________

1. Monthly benchmark loan payment amount. Enter the monthly benchmark loan payment

amount from your Student Opportunity Contract ..................................................................... 1. $ ______________

2. Monthly eligible education loan payment amount. Enter the monthly amount of eligible

education loan payments due during your tax year beginning in 2008, whether paid or not,

and regardless of whether the amount was paid by you, your employer or someone else ..... 2. $ ______________

a) Multiply the amount on line 2 ($__________) by the number of months (____) each

payment was due during your tax year. Enter the result here: $__________.

b) Enter the total annual eligible education loan payment amount

actually paid by you, your employer(s) and anyone else

during your tax year beginning in 2008. Enter the result here: $__________.

If line b is more than line a, STOP. You do not qualify for the credit. Do not fi le this

worksheet with your return.

If line b is equal to or less than line a, go to line 3 and complete the remainder of the

worksheet. Also, to support amounts entered on lines a and b, attach documentation

from each lender showing the monthly payments due and the monthly payments

actually made during your tax year beginning in 2008.

3. Enter line 1 or line 2, whichever is less .................................................................................... 3. $ ______________

4. Percentage of coursework completed. Enter the percentage of coursework completed

from your Student Opportunity Contact. Enter the amount as a decimal (for example,

enter 25% as .2500) ................................................................................................................. 4.

___ . ___ ___ ___ ___

5. Multiply line 3 by line 4. Enter the result on this line. .............................................................. 5. $ ______________

6. With respect to that period of the tax year you were a resident of Maine working for an

employer located in Maine, enter the number of months you, your employer and/or

anyone else made eligible education loan payments. See instructions. .............................. 6. $ ______________

7. Multiply line 5 by line 6. Enter the result on this line. .............................................................. 7. $ ______________

8. a) Enter the total amount of eligible education loan payments

you paid during your tax year beginning in 2008 ...................8a. $ ________________

b) Enter the amount from line 2b above ....................................8b. $ ________________

9. Percent of coursework completed. Enter the decimal amount from line 4 above. .............. 9.

___ . ___ ___ ___ ___

10. Multiply line 8b by line 9. Enter the result on this line. .......................................................... 10. $ ______________

11. Enter line 7 or line 10, whichever is less. ............................................................................... 11. $ ______________

12. Your portion of line 11. Divide line 8a by line 8b. Enter result here. .................................. 12.

___ . ___ ___ ___ ___

13. Credit Amount. Multiply line 11 by line 12. Enter the result here and on Form 1040ME,

Schedule A, line 10 ................................................................................................................ 13. $ ______________

14. Carryforward to 2009. If you are unable to use the entire credit amount shown on

line 13 because of the limitation on Form 1040ME, Schedule A, line 20, enter the unused

portion of the credit here. See instructions ......................................................................... 14. $ ______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1