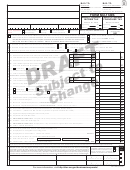

S CORPORATION WITH OTHER INCOME AND DEDUCTIONS

FORM

NEBRASKA SCHEDULE II — Adjustments to Ordinary Income

nebraska

1120-SN

• Read instructions

department

• Enter amounts from Schedule K, Federal Form 1120S

of revenue

Name as Shown on Form 1120-SN

Nebraska Identification Number

24 —

ADJUSTMENTS INCREASING ORDINARY INCOME

TOTAL

1 Net income from rental real estate activities ........................................................................................ 1

2 Net income from other rental activities ................................................................................................ 2

3 Portfolio income:

a Interest income ............................................................................................................................... 3 a

b Dividend income ............................................................................................................................. 3 b

c Royalty income ............................................................................................................................... 3 c

d Net short-term capital gain .............................................................................................................. 3 d

e Net long-term capital gain ............................................................................................................... 3 e

f Other portfolio income ..................................................................................................................... 3 f

4 Net gain under Section 1231 (other than casualty or theft) .................................................................. 4

5 Non-Nebraska state and local bond interest and dividend income (see instructions) .......................... 5

6 Bonus depreciation add-back (see instructions)

Total federal bonus depreciation $ _____________ x .85 = $_____________. Enter on line 6 ........... 6

7 Enhanced Section 179 expense deduction add-back (see instructions) Total federal Section 179

expense deduction $ _____________ – $25,000 = $______________ Enter on line 7. If less than

zero, enter zero ................................................................................................................................... 7

8 Other income (attach schedule) .......................................................................................................... 8

9 TOTAL adjustments increasing ordinary income (total of lines 1 through 8). Enter here and on

line 2, Form 1120-SN .......................................................................................................................... 9

ADJUSTMENTS DECREASING ORDINARY INCOME

TOTAL

10 Income from U.S. government obligations (see instructions) .............................................................. 10

11 Net loss from rental real estate activities ............................................................................................. 11

12 Net loss from other rental activities ..................................................................................................... 12

13 Portfolio loss:

a Net short-term capital loss .............................................................................................................. 13 a

b Net long-term capital loss ............................................................................................................... 13 b

c Other portfolio loss .......................................................................................................................... 13 c

14 Net loss under Section 1231 ............................................................................................................... 14

15 Other loss not included in lines 11 through 14 ..................................................................................... 15

16 Charitable contributions ....................................................................................................................... 16

17 Section 179 expense deduction .......................................................................................................... 17

18 Deductions related to portfolio income ................................................................................................ 18

19 Other deductions (attach schedule) .................................................................................................... 19

20 TOTAL adjustments decreasing ordinary income (total of lines 10 through 19). Enter here and

on line 4, Form 1120-SN ..................................................................................................................... 20

11-2003

8-289-1974 Rev.

Supersedes 8-289-1974 Rev. 11-2002

1

1 2

2 3

3 4

4