Form 104cr - Individual Credit Schedule - 2007 Page 2

ADVERTISEMENT

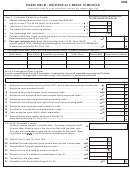

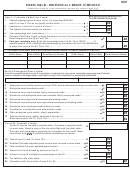

FORM 104CR - 2007 INDIVIDUAL CREDIT SCHEDULE

Page 2

Taxpayer’s Name

Social Security Number

Other Personal Credits–

.00

26 Plastic recycling investment credit ............................................................. 26

.00

27

Colorado minimum tax credit (2007 federal minimum tax Cr $ _ ___________ ) .... 27

.00

28 Historic property preservation credit .......................................................... 28

.00

29 Child care center investment credit ............................................................ 29

.00

30 employer child care facility investment credit ............................................ 3 0

.00

31 School-to-career investment credit ............................................................ 31

.00

32 Colorado works program credit .................................................................. 3 2

.00

33 Child care contribution credit ..................................................................... 3 3

.00

34 Rural technology enterprise zone credit (carryforward only) ..................... 3 4

.00

35 Long term care insurance credit ................................................................ 3 5

.00

36 Contaminated land redevelopment credit .................................................. 3 6

.00

37 Low-income housing credit ........................................................................ 3 7

.00

38 Weather related livestock sale credit (carryforward only) .......................... 3 8

.00

39 Aircraft manufacturer new employee credit ............................................... 3 9

.00

40 Total of lines 26 through 39 .................................................................................................... 40

.00

41 Total personal credits, add lines 25 and 40. enter here and on line 19, Form 104 ................ 41

42 Alternative fuel vehicle credit: vehicle Make ________ Year _____

Model _____________________________ New

Used

Did this vehicle permanently displace a power source from

Colorado that was 10 years old or older?

Yes

No

.00

.... 42

Check whether this vehicle was

Leased

Purchased

.00

43 Alternative fuel refueling facility credit ...................................................... 43

44 Total alternative fuel credits-Add lines 42 and 43. enter here and on

.00

line 20, Form 104 .................................................................................................................. 44

.00

45 Gross conservation easement credit, enter here and on line 21, Form 104 ....................... 45

If the total of lines 17, 41, 44, and 45 on this Form 104CR exceeds the total of lines 15 and 16, Form 104, see

the limitation at the bottom of this form.

Credits to be carried forward to 2008:

LIMITATIOn: The total credits you claim on lines 17, 41, 44 and 45 of this Form 104CR may not exceed the total tax on lines 15 and 16

of your income tax return, Form 104. If you have excess credits, you must choose which credits you are going to use against your 2007

tax and enter those amounts on lines 19 through 22 of Form 104. Most unused 2007 credits may be carried forward and claimed on

your 2008 Colorado income tax return.

ATTACH THIS FORM TO yOUR COMPLETED InCOME TAx RETURn FORM 104

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2