Instructions

Print

Reset

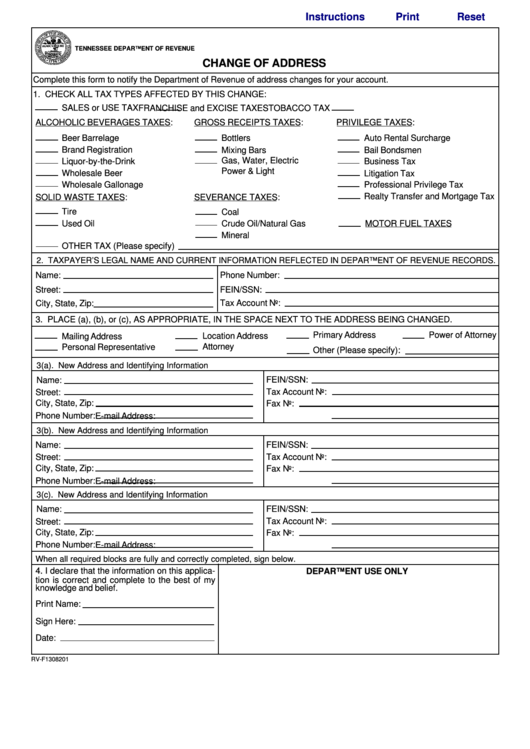

TENNESSEE DEPARTMENT OF REVENUE

CHANGE OF ADDRESS

Complete this form to notify the Department of Revenue of address changes for your account.

1. CHECK ALL TAX TYPES AFFECTED BY THIS CHANGE:

SALES or USE TAX

FRANCHISE and EXCISE TAXES

TOBACCO TAX

ALCOHOLIC BEVERAGES TAXES:

GROSS RECEIPTS TAXES:

PRIVILEGE TAXES:

Beer Barrelage

Bottlers

Auto Rental Surcharge

Brand Registration

Mixing Bars

Bail Bondsmen

Gas, Water, Electric

Liquor-by-the-Drink

Business Tax

Power & Light

Wholesale Beer

Litigation Tax

Wholesale Gallonage

Professional Privilege Tax

Realty Transfer and Mortgage Tax

SOLID WASTE TAXES:

SEVERANCE TAXES:

Tire

Coal

Used Oil

Crude Oil/Natural Gas

MOTOR FUEL TAXES

Mineral

OTHER TAX (Please specify)

2. TAXPAYER’S LEGAL NAME AND CURRENT INFORMATION REFLECTED IN DEPARTMENT OF REVENUE RECORDS.

Name:

Phone Number:

FEIN/SSN:

Street:

City, State, Zip:

Tax Account No:

3. PLACE (a), (b), or (c), AS APPROPRIATE, IN THE SPACE NEXT TO THE ADDRESS BEING CHANGED.

Primary Address

Power of Attorney

Location Address

Mailing Address

Personal Representative

Attorney

Other (Please specify):

3(a). New Address and Identifying Information

Name:

FEIN/SSN:

Street:

Tax Account No:

City, State, Zip:

Fax No:

Phone Number:

E-mail Address:

3(b). New Address and Identifying Information

Name:

FEIN/SSN:

Street:

Tax Account No:

City, State, Zip:

Fax No:

Phone Number:

E-mail Address:

3(c). New Address and Identifying Information

FEIN/SSN:

Name:

Tax Account No:

Street:

City, State, Zip:

Fax No:

Phone Number:

E-mail Address:

When all required blocks are fully and correctly completed, sign below.

4. I declare that the information on this applica-

DEPARTMENT USE ONLY

tion is correct and complete to the best of my

knowledge and belief.

Print Name:

Sign Here:

Date:

RV-F1308201

1

1 2

2