Form Rv-F1320901 - Business Tax Worksheet - Tennessee Department Of Revenue

ADVERTISEMENT

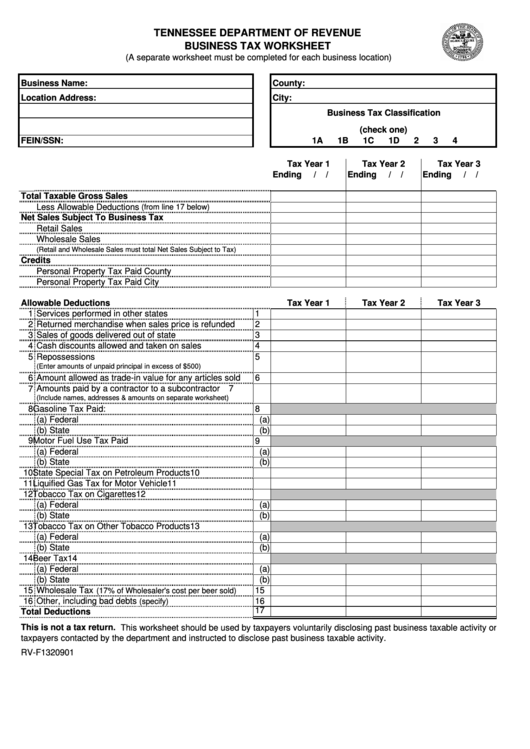

TENNESSEE DEPARTMENT OF REVENUE

BUSINESS TAX WORKSHEET

(A separate worksheet must be completed for each business location)

Business Name:

County:

Location Address:

City:

Business Tax Classification

(check one)

FEIN/SSN:

1A

1B

1C

1D

2

3

4

Tax Year 1

Tax Year 2

Tax Year 3

Ending

/

/

Ending

/

/

Ending

/

/

Total Taxable Gross Sales

Less Allowable Deductions

(from line 17 below)

Net Sales Subject To Business Tax

Retail Sales

Wholesale Sales

(Retail and Wholesale Sales must total Net Sales Subject to Tax)

Credits

Personal Property Tax Paid County

Personal Property Tax Paid City

Allowable Deductions

Tax Year 1

Tax Year 2

Tax Year 3

1 Services performed in other states

1

2 Returned merchandise when sales price is refunded

2

3 Sales of goods delivered out of state

3

4 Cash discounts allowed and taken on sales

4

5 Repossessions

5

(Enter amounts of unpaid principal in excess of $500)

6 Amount allowed as trade-in value for any articles sold

6

7 Amounts paid by a contractor to a subcontractor

7

(Include names, addresses & amounts on separate worksheet)

8 Gasoline Tax Paid:

8

(a) Federal

(a)

(b) State

(b)

9 Motor Fuel Use Tax Paid

9

(a) Federal

(a)

(b) State

(b)

10 State Special Tax on Petroleum Products

10

11 Liquified Gas Tax for Motor Vehicle

11

12 Tobacco Tax on Cigarettes

12

(a) Federal

(a)

(b) State

(b)

13 Tobacco Tax on Other Tobacco Products

13

(a) Federal

(a)

(b) State

(b)

14 Beer Tax

14

(a) Federal

(a)

(b) State

(b)

15 Wholesale Tax

15

(17% of Wholesaler's cost per beer sold)

16 Other, including bad debts

16

(specify)

17

Total Deductions

This is not a tax return. This worksheet should be used by taxpayers voluntarily disclosing past business taxable activity or

taxpayers contacted by the department and instructed to disclose past business taxable activity.

RV-F1320901

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1