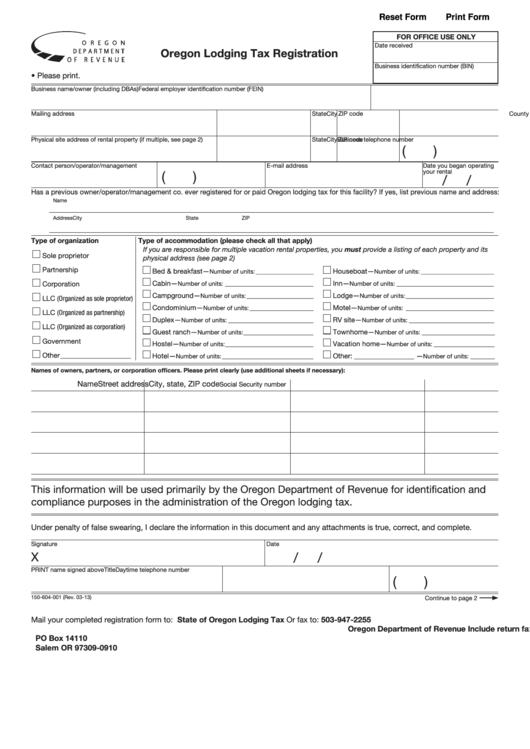

Reset Form

Print Form

FOR OFFICE USE ONLY

Date received

Oregon Lodging Tax Registration

Business identification number (BIN)

• Please print.

Business name/owner (including DBAs)

Federal employer identification number (FEIN)

Mailing address

City

State

ZIP code

County

Physical site address of rental property (if multiple, see page 2)

City

State

ZIP code

Business telephone number

(

)

Contact person/operator/management co.

Daytime telephone number

E-mail address

Date you began operating

your rental

(

)

/

/

Has a previous owner/operator/management co. ever registered for or paid Oregon lodging tax for this facility? If yes, list previous name and address:

Name

Address

City

State

ZIP

Type of organization

Type of accommodation (please check all that apply)

If you are responsible for multiple vacation rental properties, you must provide a listing of each property and its

Sole proprietor

physical address (see page 2)

Partnership

Bed & breakfast—

Houseboat—

Number of units: ___________________

Number of units: ________________________

Cabin—

Inn—

Corporation

Number of units: _____________________________

Number of units: ________________________________

Campground—

Lodge—

Number of units: ______________________

Number of units: _____________________________

LLC (Organized as sole proprietor)

Condominium—

Motel—

Number of units: _____________________

Number of units: _____________________________

LLC (Organized as partnership)

Duplex—

RV site—

Number of units: ____________________________

Number of units: ____________________________

LLC (Organized as corporation)

Guest ranch—

Townhome—

Number of units: _______________________

Number of units: ________________________

Government

Hostel—

Vacation home—

Number of units: _____________________________

Number of units: ____________________

Other ____________________

Hotel—

Other: _________________ —

Number of units: ______________________________

Number of units: ________

Names of owners, partners, or corporation officers. Please print clearly (use additional sheets if necessary):

Name

Street address

City, state, ZIP code

Social Security number

This information will be used primarily by the Oregon Department of Revenue for identification and

compliance purposes in the administration of the Oregon lodging tax.

Under penalty of false swearing, I declare the information in this document and any attachments is true, correct, and complete.

Signature

Date

X

/

/

PRINT name signed above

Title

Daytime telephone number

(

)

150-604-001 (Rev. 03-13)

Continue to page 2

Mail your completed registration form to:

State of Oregon Lodging Tax

Or fax to:

503-947-2255

Oregon Department of Revenue

Include return fax number

PO Box 14110

Salem OR 97309-0910

1

1 2

2