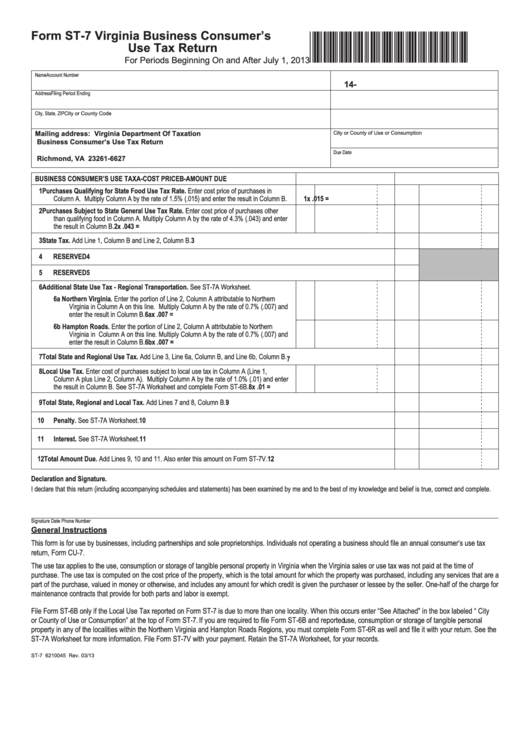

Form ST-7

Virginia Business Consumer’s

*VAST07113888*

Use Tax Return

For Periods Beginning On and After July 1, 2013

Name

Account Number

14-

Address

Filing Period Ending

City, State, ZIP

City or County Code

Mailing address:

Virginia Department Of Taxation

City or County of Use or Consumption

Business Consumer’s Use Tax Return

P.O. Box 26627

Due Date

Richmond, VA 23261-6627

BUSINESS CONSUMER’S USE TAX

A-COST PRICE

B-AMOUNT DUE

1

Purchases Qualifying for State Food Use Tax Rate. Enter cost price of purchases in

1

x .015 =

Column A. Multiply Column A by the rate of 1.5% (.015) and enter the result in Column B.

2

Purchases Subject to State General Use Tax Rate. Enter cost price of purchases other

than qualifying food in Column A. Multiply Column A by the rate of 4.3% (.043) and enter

the result in Column B.

2

x .043 =

3

State Tax. Add Line 1, Column B and Line 2, Column B.

3

4

RESERVED

4

5

RESERVED

5

6

Additional State Use Tax - Regional Transportation. See ST-7A Worksheet.

6a

Northern Virginia. Enter the portion of Line 2, Column A attributable to Northern

Virginia in Column A on this line. Multiply Column A by the rate of 0.7% (.007) and

enter the result in Column B.

6a

x .007 =

6b

Hampton Roads. Enter the portion of Line 2, Column A attributable to Northern

Virginia in Column A on this line. Multiply Column A by the rate of 0.7% (.007) and

6b

x .007 =

enter the result in Column B.

7

Total State and Regional Use Tax. Add Line 3, Line 6a, Column B, and Line 6b, Column B.

7

8

Local Use Tax. Enter cost of purchases subject to local use tax in Column A (Line 1,

Column A plus Line 2, Column A). Multiply Column A by the rate of 1.0% (.01) and enter

the result in Column B. See ST-7A Worksheet and complete Form ST-6B.

8

x .01 =

9

Total State, Regional and Local Tax. Add Lines 7 and 8, Column B.

9

10

Penalty. See ST-7A Worksheet.

10

11

Interest. See ST-7A Worksheet.

11

12

Total Amount Due. Add Lines 9, 10 and 11. Also enter this amount on Form ST-7V.

12

Declaration and Signature.

I declare that this return (including accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is true, correct and complete.

Signature

Date

Phone Number

General Instructions

This form is for use by businesses, including partnerships and sole proprietorships. Individuals not operating a business should file an annual consumer’s use tax

return, Form CU-7.

The use tax applies to the use, consumption or storage of tangible personal property in Virginia when the Virginia sales or use tax was not paid at the time of

purchase. The use tax is computed on the cost price of the property, which is the total amount for which the property was purchased, including any services that are a

part of the purchase, valued in money or otherwise, and includes any amount for which credit is given the purchaser or lessee by the seller. One-half of the charge for

maintenance contracts that provide for both parts and labor is exempt.

File Form ST-6B only if the Local Use Tax reported on Form ST-7 is due to more than one locality. When this occurs enter “See Attached” in the box labeled “ City

or County of Use or Consumption” at the top of Form ST-7. If you are required to file Form ST-6B and reported use, consumption or storage of tangible personal

property in any of the localities within the Northern Virginia and Hampton Roads Regions, you must complete Form ST-6R as well and file it with your return. See the

ST-7A Worksheet for more information. File Form ST-7V with your payment. Retain the ST-7A Worksheet, for your records.

ST-7 6210045 Rev. 03/13

1

1 2

2 3

3