Print and Reset Form

Reset Form

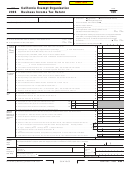

Schedule C Rental Income from Real Property and Personal Property Leased with Real Property

Note: For rental income from debt-financed property, use Schedule D, R&TC Section 23701g, Section 23701i, and Section 23701n organizations. See instructions for exceptions.

1 Description of property

2 Rent received

3 Percentage of rent attributable

or accrued

to personal property

%

%

%

4 Complete if any item in column 3 is more than 50%, or for any item

5 Complete if any item in column 3 is more than 10%, but not more than 50%

if the rent is determined on the basis of profit or income

(a) Deductions directly connected

(b) Income includible, column 2

(a) Gross income reportable,

(b) Deductions directly connected with

(c) Net income includible, column 5(a)

(attach schedule)

less column 4(a)

column 2 x column 3

personal property (attach schedule)

less column 5(b)

Add columns 4(b) and 5(c). Enter here and on Side 2, Part I, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule D Unrelated Debt-Financed Income

1 Description of debt-financed property

2 Gross income from or

3 Deductions directly connected with or allocable to debt-financed property

allocable to debt-financed

(b) Other deductions (attach

(a) Straight line depreciation

property

(attach schedule)

schedule)

4 Amount of average acquisition

5 Average adjusted basis of or

6 Debt basis

7 Gross income reportable,

8 Allocable deductions,

9 Net income (or loss) includible,

indebtedness on or allocable

allocable to debt-financed

percentage,

column 2 x column 6

total of columns 3(a) and

column 7 less column 8

to debt-financed property

property (attach schedule)

column 4 ÷

3(b) x column 6

(attach schedule)

column 5

%

%

%

Total. Enter here and on Side 2, Part I, line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule E Investment Income of an R&TC Section 23701g, 23701i, or 23701n Organization

1 Description

2 Amount

3 Deductions directly connected

4 Net investment income,

5 Set-asides

6 Balance of investment income,

(attach schedule)

column 2 less column 3

(attach schedule)

column 4 less column 5

Total. Enter here and on Side 2, Part I, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter gross income from members (dues, fees, charges, or similar amounts) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule F Income (Annuities, Interest, Rents, and Royalties) From Controlled Organizations

1 Name and address of controlled organizations

2 Gross income from

3 Deductions directly

4 Exempt controlled organizations

controlled organizations

connected with

column 2 income

(a) Unrelated business

(b) Taxable income computed as

(c) Percentage,

(attach schedule)

taxable income

though not exempt under

column (a) ÷

Section 23701, or the amount in

column (b)

column (a), whichever is greater

%

%

%

5 Nonexempt controlled organizations

6 Gross income reportable,

7 Allowable deductions,

8 Net income includible,

column 2 x column 4(c)

column 3 x column 4(c)

column 6 less column 7

(a) Excess taxable

(b) Taxable income or amount in

(c) Percentag

e,

or column 5(c)

or column 5(c)

income

column (a), whichever is greater

col. (a) ÷ (b

)

%

%

%

Total. Enter here and on Side 2, Part I, line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule G Exploited Exempt Activity Income, other than Advertising Income

1 Description of exploited activity (attach schedule

2 Gross unrelated

3 Expenses directly 4 Net income from

5 Gross income

6 Expenses

7 Excess exempt

8 Net income

if more than one unrelated activity is exploiting

business income

connected with

unrelated trade

from activity that is

attributable

expense,

includible,

the same exempt activity)

from trade or

production of

or business,

not unrelated

to column 5

column 6 less

column 4 less

business

unrelated

column 2 less

business income

column 5 but not

column 7 but

business income

column 3

more than

not less than

column 4

zero

Total. Enter here and on Side 2, Part I, line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10904303

Form 109

2004 Side 3

C1

1

1 2

2 3

3 4

4 5

5