Form Boe-531-Ae1 - Computation Schedule For District Tax Page 3

ADVERTISEMENT

Proposed

BOE-531-AE1 (S2F) REV. 14 (4-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

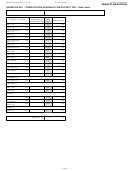

SCHEDULE AE1 - COMPUTATION SCHEDULE FOR DISTRICT TAX - Short Form

ACCOUNT NO.

REPORTING PERIOD

A5

ALLOCATE LINE A4 TO

TAX

DISTRICT TAX AREAS

DISTRICT TAX DUE

CORRECT DISTRICT(S)

RATE

SONOMA CO.

.00

259

.0075

(Eff. 4-1-11)

City of Cotati

.00

.0125

261

(Eff. 10-1-10)

City of Healdsburg

.00

343

.0125

(Eff. 4-1-13)

City of Rohnert Park

.00

262

.0125

(Eff. 10-1-10)

City of Santa Rosa

.00

264

.0125

(Eff. 4-1-11)

City of Sebastopol

345

.015

.00

(Eff. 4-1-13)

City of Sonoma

297

.0125

.00

(Eff. 10-1-12)

.00

STANISLAUS CO.

059

.00125

City of Ceres

.00

173

.00625

(Eff. 4-1-08)

City of Oakdale

.00

279

.00625

(Eff. 4-1-12)

TULARE CO.

.00

162

.005

(Eff. 4-1-07)

.00

City of Dinuba

.0125

165

.00

.01

164

City of Farmersville

.00

.01

City of Porterville

166

.00

167

.01

City of Tulare

.00

City of Visalia

163

.0075

TUOLUMNE CO.

.00

City of Sonora

093

.005

VENTURA CO.

City of Oxnard

213

.005

.00

(Eff. 4-1-09)

City of Port Hueneme

214

.00

.005

(Eff. 4-1-09)

YOLO CO.

City of Davis

.00

088

.005

City of West

.00

081

.005

Sacramento

City of Woodland

.00

236

.0075

(Eff. 10-1-10)

YUBA CO.

City of Wheatland

.00

265

.005

(Eff. 4-1-11)

.00

$

SUBTOTAL (5)

Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3