Vessel Excise Tax Monthly Return Form

ADVERTISEMENT

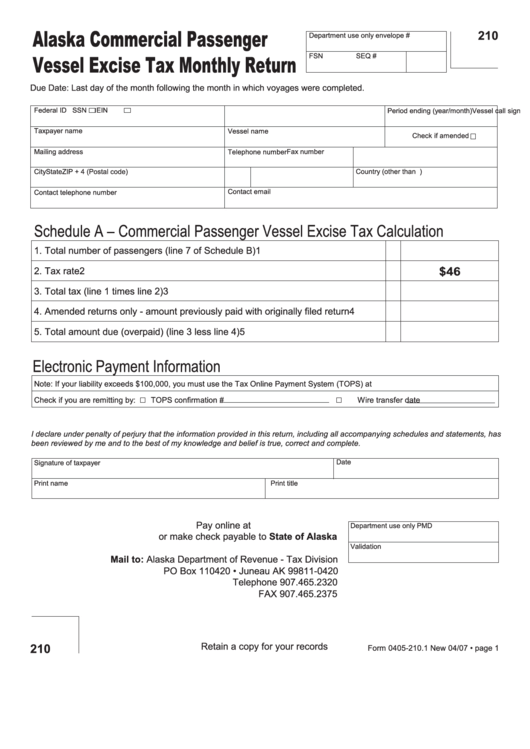

Alaska Commercial Passenger

210

Department use only envelope #

Vessel Excise Tax Monthly Return

FSN

SEQ #

Due Date: Last day of the month following the month in which voyages were completed.

Federal ID

SSN

EIN

Vessel call sign

Period ending (year/month)

Taxpayer name

Vessel name

Check if amended

Mailing address

Fax number

Telephone number

City

State

ZIP + 4 (Postal code)

Country (other than U.S.)

Contact email

Contact telephone number

Schedule A – Commercial Passenger Vessel Excise Tax Calculation

1. Total number of passengers (line 7 of Schedule B)

1

$46

2. Tax rate

2

3. Total tax (line 1 times line 2)

3

4. Amended returns only - amount previously paid with originally filed return

4

5. Total amount due (overpaid) (line 3 less line 4)

5

Electronic Payment Information

Note: If your liability exceeds $100,000, you must use the Tax Online Payment System (TOPS) at or wire transfer.

Check if you are remitting by:

TOPS confirmation #

Wire transfer date

I declare under penalty of perjury that the information provided in this return, including all accompanying schedules and statements, has

been reviewed by me and to the best of my knowledge and belief is true, correct and complete.

Date

Signature of taxpayer

Print name

Print title

Pay online at

Department use only PMD

or make check payable to State of Alaska

Validation

Mail to: Alaska Department of Revenue - Tax Division

PO Box 110420 • Juneau AK 99811-0420

Telephone 907.465.2320

FAX 907.465.2375

Retain a copy for your records

210

Form 0405-210.1 New 04/07 • page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2