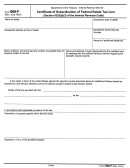

Certificate Of Subordination Of Federal Tax Lien Page 2

ADVERTISEMENT

Additional Information

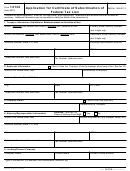

Please follow the instructions in this publication when

2. The Technical Services Group Manager will

applying for a Certificate of Subordination of Federal

have your application investigated to determine

Tax Lien.

whether to issue the certificate and will let you

know the outcome.

The Technical Services Group Manager has the

authority to issue a certificate of subordination of a lien

3. A certificate of subordination under section

that is filed on any part of a taxpayer's property subject

6325(d)(1) will be issued upon receipt of the

to the lien. The following sections and provisions of the

amount determined to be the interest of the

Internal Revenue Code apply:

United States in the subject property under

the Federal tax lien. Make payments in cash,

or by a certified, cashier's, or treasurer's

Section 6325(d)(1) - If you pay an amount equal to the

check. It must be drawn on any bank or trust

lien or interest to which the certificate subordinates the

company incorporated under the laws of the

lien of the United States.

United States, or of any state, or possession

of the United States. Payment can also be

Section 6325(d)(2) - If the Technical Services Group

made by United States postal, bank, express,

Manager believes that issuance of the certificate will

or telegraph money order.

(If you pay by per-

increase the amount the United States may realize, or

sonal check, issuance of the certificate of sub-

the collection of the tax liability will be easier. This

ordination will be delayed until the bank honors

applies to the property that the certificate is for or any

the check.)

other property subject to the lien.

4. In certain cases the Technical Services Group

1. No payment is required for the issuance of a

Manager may require additional information such

certificate under section 6325(d)(2) of the Code.

as written appraisals by disinterested third parties,

Payment is required for certificates issued under

a list of all the taxpayer's property, or other infor-

section 6325(d)(1). However, do not send the

mation needed to make a determination.

payment with your application. The Technical

Services Group Manager will notify you after

determining the amount due.

Publication 784 (Rev. 1-2004)

Department of Treasury

Catalog Number 46756T

Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2