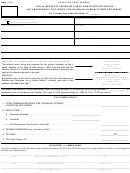

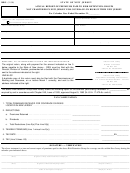

ARKANSAS INSURANCE DEPARTMENT

2011 FORM AID AC FMAA-T

ACCOUNTING DIVISION

ACCOUNTING DIVISION

DUE MARCH 1, 2012

1200 WEST THIRD STREET

______ ORIGINAL FILING

LITTLE ROCK, AR 72201-1904

PHONE: (501) 371-2605

______ AMENDED FILING

ANNUAL REPORT OF PREMIUMS AND TAXES

______REFUND DUE

OF ALL FARMERS MUTUAL AID ASSOCIATIONS

STATE OF DOMICILE

NAIC COMPANY CODE

(5 digit code)

COMPANY NAME

MAILING ADDRESS

CONTACT PERSON

TITLE

TELEPHONE NUMBER

EXT

FAX NUMBER

EMAIL ADDRESS

Pursuant to ACA 23-73-105(f)(1) and (3), net direct premiums written on policies containing burglary and theft, glass, leakage and fire

extinguisher equipment, livestock, miscellaneous coverage, and liability coverages, written as a supplement to a fire insurance policy or

package commonly referred to as a homeowner or farmowner policy, are subject to premium tax provisions of ACA 26-57-601, et seq.

0.00

1.

Direct Net Written Premiums

$______________________

0.00

2.

Tax Thereon at 2-1/2%

$______________________

0.00

3.

Less Affordable Neighborhood Housing Credit

$(_____________________)

0.00

4.

Less Low-Income Housing Tax Credit

$(_____________________)

0.00

5.

Less AR Historic Rehab Income Tax Credit

$(_____________________)

0.00

6.

Less Delta Geotourism Incentive Tax Credit

$(_____________________)

0.00

7.

Subtotal of Taxes Due

$___________________

0.00

8.

Less Capital Development Corporation Tax Credit

$(_____________________)

0.00

9.

Less Coal Mining Enterprise Credit

$(_____________________)

0.00

10. Less Equity Investment Incentive Tax Credit

$(_____________________)

0.00

11. TOTAL TAXES DUE

$______________________

0.00

12. Less 2011 prepayments (from below)

$(_____________________)

0.00

13. NET PAYMENT DUE

$___________________

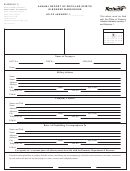

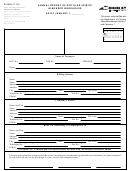

2011 FORM AID AC EST-Q PREPAYMENTS

First Quarter

check #

$

0

0.00

Second Quarter check #

$

0

0.00

Third Quarter

check #

$

0

0.00

Page 1 of 2

1

1 2

2 3

3 4

4