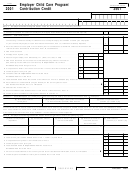

Part II Employer Childcare Contribution Credit. Read the instructions before completing this part.

(a)

(b)

(c)

(d)

(e)

Name of employee’s

Contribution amount

30% (.30) of column (b),

Number of weeks of

Credit amount,

dependent

but not more than $360

care ÷ 42, but not

Column (c) x column (d)

more than 100%

� _____________________

$ _____________________

$ _____________________

____________________%

$ _____________________

_____________________

_____________________

_____________________

____________________

_____________________

_____________________

_____________________

_____________________

____________________

_____________________

2 Pass-through credit from Schedule K-1 (100S, 541, 565, or 568) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Total current year credits. Add amounts in line 1, column (e), and line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 S corporations only: Enter (.333) of the amount on line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

00

5 Credit carryover from 2009. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6 Total available credit. S corporations: Add line 4 and line 5

All others: Add line 3 and line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

7a Amount of credit claimed on the current year tax return.

(Do not include any assigned credit claimed on form FTB 3544A.)

See General Information, Part II, D, Limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7a

00

7b Total credit assigned to other corporations within combined reporting group from

form FTB 3544, column (g). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

00

8 Credit carryover available for future years. Add line 7a and line 7b, subtract the result from line 6 . . . . . . 8

00

What’s New

Limited Liability Company Return of Income.

FTB Pub. 737, Tax Information for Registered

Show the pass-through credit for each

Domestic Partners.

Assigned Credit Claimed by Assignee – For

shareholder, beneficiary, partner, or member

The Employer Childcare Program Credit and

taxable years beginning on or after January 1,

on Schedule K-1 (100S, 541, 565, or 568),

the Employer Childcare Contribution Credit will

2010, California Revenue and Taxation Code

Share of Income, Deductions, Credits, etc.

be available until January 1, 2012.

(R&TC) Section 23663 allows an eligible

Part I — Employer Childcare

assignee to claim assigned credits, received

A Purpose

this taxable year or carryover from prior years,

Program Credit

Use form FTB 3501, Employer Childcare

against its tax liabilities. R&TC Section 23663

Program/Contribution Credit, to figure a credit

allows assignor to assign an eligible credit to

B Description

if you are an employer and have established or

eligible assignee for taxable years beginning

contributed to a qualified employee childcare

You may claim a credit of 30% (.30) of

on or after July 1, 2008. For more information,

program, constructed a childcare facility in

costs you paid or incurred for establishing a

get form FTB 3544A, List of Assigned Credit

California, or contributed to California childcare

Received and/or Claimed by Assignee, and

childcare program, or constructing a childcare

information and referral services. See R&TC

form FTB 3544, Election to Assign Credit

facility in California for use primarily by the

Sections 17052.17, 17052.18, 23617, and

Within Combined Reporting Group. Also, go to

children of your employees, the children of

23617.5 for more information.

your tenants’ employees, or both.

ftb.ca.gov and search for credit assignment.

Pass-Through Entities

Two or more employers (other than a husband

General Information

and wife or RDPs) who share in the costs

Also, use form FTB 3501 to figure any

eligible for the credit may claim the credit

New Job Credit – For taxable years beginning

recapture of the employer childcare program

on or after January 1, 2009, a new jobs credit

in proportion to the respective share of the

credit and to claim pass-through employer

will be allowed to qualified employers in the

costs they paid or incurred. When a husband

childcare program/contribution credits you

amount of $3,000 for each qualified full-time

and wife or RDPs file separate returns, either

received from S corporations, estates or trusts,

spouse/RDP may claim the credit or each may

employee hired during the taxable year. For

partnerships, or limited liability companies

more information ftb.ca.gov and search for

claim half (50%) of the credit.

(LLCs) classified as partnerships.

new jobs or get FTB 3527, New jobs Credit.

S corporations, estates or trusts, partnerships,

C Qualifications

Registered Domestic Partners (RDPs) – For

and LLCs classified as partnerships should

Childcare Program Startup

purposes of California income tax, references

complete form FTB 3501 to figure the credit to

to a spouse, husband, or wife also refer to a

pass through to shareholders, beneficiaries,

You may claim this credit if you paid or

RDP, unless otherwise specified. When we use

partners, or members. Attach this form to

incurred costs for the startup expenses

the initials RDP they refer to both a California

Form 100S, California S Corporation Franchise

of establishing a childcare program or

registered domestic “partner” and a California

or Income Tax Return; Form 541, California

constructing childcare facilities in California,

registered domestic “partnership,” as

Fiduciary Income Tax Return; Form 565,

and you either:

applicable. For more information on RDPs, get

Partnership Return of Income; or Form 568,

• Are an employer.

Side 2 FTB 3501 2010

7232103

1

1 2

2