Form Tcd-1 - Tax Credit Disclosure Agreement Or Authorization To Disclose Confidential Tax Information Relating To Tax Credits - Virginia Department Of Taxation

ADVERTISEMENT

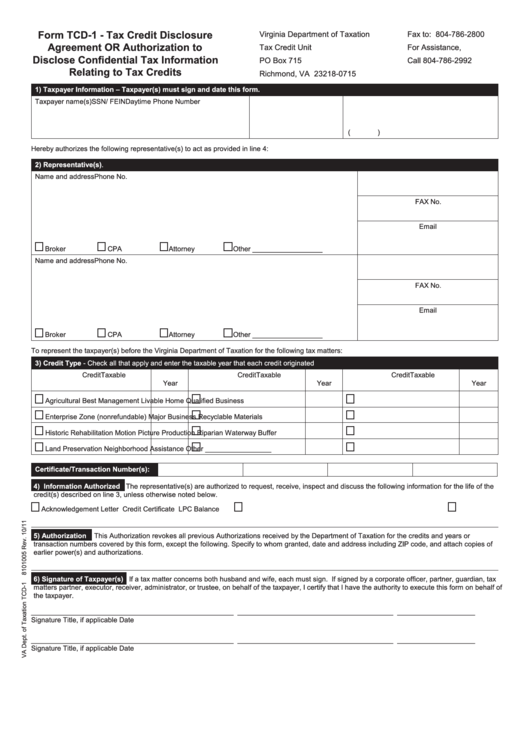

Form TCD-1 - Tax Credit Disclosure

Virginia Department of Taxation

Fax to: 804-786-2800

Agreement OR Authorization to

Tax Credit Unit

For Assistance,

Disclose Confidential Tax Information

PO Box 715

Call 804-786-2992

Relating to Tax Credits

Richmond, VA 23218-0715

1) Taxpayer Information – Taxpayer(s) must sign and date this form.

Taxpayer name(s)

SSN/ FEIN

Daytime Phone Number

(

)

Hereby authorizes the following representative(s) to act as provided in line 4:

2) Representative(s).

Name and address

Phone No.

FAX No.

Email

Broker

CPA

Attorney

Other __________________

Name and address

Phone No.

FAX No.

Email

Broker

CPA

Attorney

Other __________________

To represent the taxpayer(s) before the Virginia Department of Taxation for the following tax matters:

3) Credit Type - Check all that apply and enter the taxable year that each credit originated

Credit

Taxable

Credit

Taxable

Credit

Taxable

Year

Year

Year

Agricultural Best Management

Livable Home

Qualified Business

Enterprise Zone (nonrefundable)

Major Business

Recyclable Materials

Historic Rehabilitation

Motion Picture Production

Riparian Waterway Buffer

Land Preservation

Neighborhood Assistance

Other _________________

Certificate/Transaction Number(s):

4) Information Authorized

The representative(s) are authorized to request, receive, inspect and discuss the following information for the life of the

credit(s) described on line 3, unless otherwise noted below.

Acknowledgement Letter

Credit Certificate

LPC Balance

5) Authorization

This Authorization revokes all previous Authorizations received by the Department of Taxation for the credits and years or

transaction numbers covered by this form, except the following. Specify to whom granted, date and address including ZIP code, and attach copies of

earlier power(s) and authorizations.

6) Signature of Taxpayer(s)

If a tax matter concerns both husband and wife, each must sign. If signed by a corporate officer, partner, guardian, tax

matters partner, executor, receiver, administrator, or trustee, on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of

the taxpayer.

____________________________________________________

________________________________________

____________________

Signature

Title, if applicable

Date

____________________________________________________

________________________________________

____________________

Signature

Title, if applicable

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1