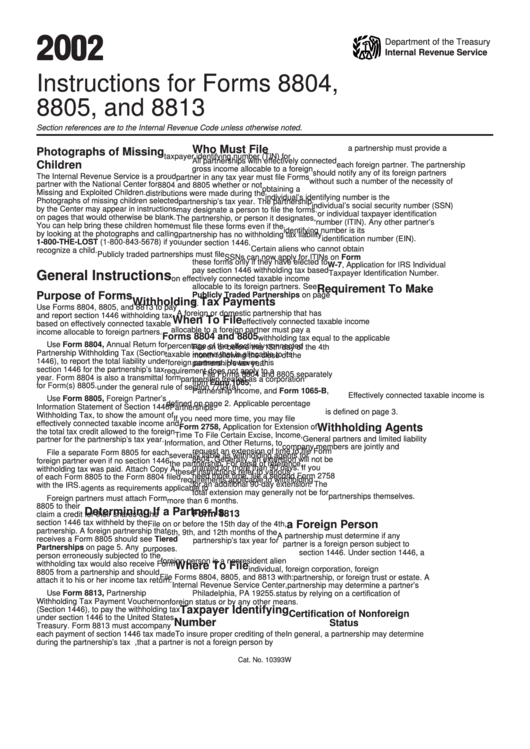

Instructions For Forms 8804, 8805, And 8813 - 2002

ADVERTISEMENT

02

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Forms 8804,

8805, and 8813

Section references are to the Internal Revenue Code unless otherwise noted.

Who Must File

a partnership must provide a U.S.

Photographs of Missing

taxpayer identifying number (TIN) for

All partnerships with effectively connected

Children

each foreign partner. The partnership

gross income allocable to a foreign

should notify any of its foreign partners

The Internal Revenue Service is a proud

partner in any tax year must file Forms

without such a number of the necessity of

partner with the National Center for

8804 and 8805 whether or not

obtaining a U.S. identifying number. An

Missing and Exploited Children.

distributions were made during the

individual’s identifying number is the

Photographs of missing children selected

partnership’s tax year. The partnership

individual’s social security number (SSN)

by the Center may appear in instructions

may designate a person to file the forms.

or individual taxpayer identification

on pages that would otherwise be blank.

The partnership, or person it designates,

number (ITIN). Any other partner’s

You can help bring these children home

must file these forms even if the

identifying number is its U.S. employer

by looking at the photographs and calling

partnership has no withholding tax liability

identification number (EIN).

1-800-THE-LOST (1-800-843-5678) if you

under section 1446.

Certain aliens who cannot obtain

recognize a child.

Publicly traded partnerships must file

SSNs can now apply for ITINs on Form

these forms only if they have elected to

W-7, Application for IRS Individual

pay section 1446 withholding tax based

General Instructions

Taxpayer Identification Number.

on effectively connected taxable income

allocable to its foreign partners. See

Requirement To Make

Purpose of Forms

Publicly Traded Partnerships on page

Withholding Tax Payments

5.

Use Forms 8804, 8805, and 8813 to pay

A foreign or domestic partnership that has

and report section 1446 withholding tax

When To File

effectively connected taxable income

based on effectively connected taxable

allocable to a foreign partner must pay a

income allocable to foreign partners.

Forms 8804 and 8805

withholding tax equal to the applicable

Use Form 8804, Annual Return for

percentage of the effectively connected

File on or before the 15th day of the 4th

Partnership Withholding Tax (Section

taxable income that is allocable to its

month following the close of the

1446), to report the total liability under

foreign partners. However, this

partnership’s tax year.

section 1446 for the partnership’s tax

requirement does not apply to a

File Forms 8804 and 8805 separately

year. Form 8804 is also a transmittal form

partnership treated as a corporation

from Form 1065, U.S. Return of

for Form(s) 8805.

under the general rule of section 7704(a).

Partnership Income, and Form 1065-B,

Effectively connected taxable income is

Use Form 8805, Foreign Partner’s

U.S. Return of Income for Electing Large

defined on page 2. Applicable percentage

Information Statement of Section 1446

Partnerships.

is defined on page 3.

Withholding Tax, to show the amount of

If you need more time, you may file

effectively connected taxable income and

Withholding Agents

Form 2758, Application for Extension of

the total tax credit allowed to the foreign

Time To File Certain Excise, Income,

General partners and limited liability

partner for the partnership’s tax year.

Information, and Other Returns, to

company members are jointly and

request an extension of time to file Form

File a separate Form 8805 for each

severally liable as withholding agents for

8804. Generally, an extension will not be

foreign partner even if no section 1446

the partnership. For ease of reference,

granted for more than 90 days. If you

withholding tax was paid. Attach Copy A

these instructions refer to various

need more time, file a second Form 2758

of each Form 8805 to the Form 8804 filed

requirements applicable to withholding

for an additional 90-day extension. The

with the IRS.

agents as requirements applicable to

total extension may generally not be for

partnerships themselves.

Foreign partners must attach Form

more than 6 months.

8805 to their U.S. income tax returns to

Determining If a Partner Is

Form 8813

claim a credit for their shares of the

section 1446 tax withheld by the

a Foreign Person

File on or before the 15th day of the 4th,

partnership. A foreign partnership that

6th, 9th, and 12th months of the

A partnership must determine if any

receives a Form 8805 should see Tiered

partnership’s tax year for U.S. income tax

partner is a foreign person subject to

Partnerships on page 5. Any U.S.

purposes.

section 1446. Under section 1446, a

person erroneously subjected to the

foreign person is a nonresident alien

withholding tax would also receive Form

Where To File

individual, foreign corporation, foreign

8805 from a partnership and should

File Forms 8804, 8805, and 8813 with:

partnership, or foreign trust or estate. A

attach it to his or her income tax return.

Internal Revenue Service Center,

partnership may determine a partner’s

Use Form 8813, Partnership

Philadelphia, PA 19255.

status by relying on a certification of

Withholding Tax Payment Voucher

nonforeign status or by any other means.

Taxpayer Identifying

(Section 1446), to pay the withholding tax

Certification of Nonforeign

under section 1446 to the United States

Number

Status

Treasury. Form 8813 must accompany

each payment of section 1446 tax made

To insure proper crediting of the

In general, a partnership may determine

during the partnership’s tax year.

withholding tax when reporting to the IRS,

that a partner is not a foreign person by

Cat. No. 10393W

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8