Instructions For Forms 8804, 8805, And 8813 - 1994

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

Instructions for Forms

8804, 8805, and 8813

Section references are to the Inter nal Revenue Code unless otherwise noted.

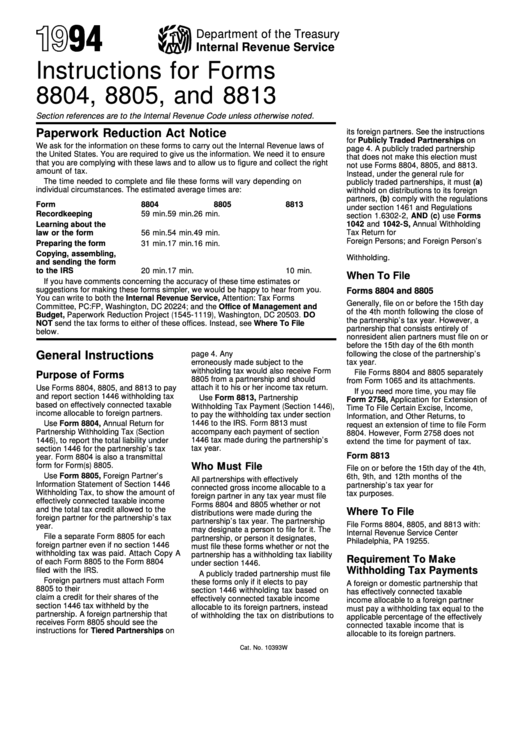

Paperwork Reduction Act Notice

its foreign partners. See the instructions

for Publicly Traded Partnerships on

We ask for the information on these forms to carry out the Internal Revenue laws of

page 4. A publicly traded partnership

the United States. You are required to give us the information. We need it to ensure

that does not make this election must

that you are complying with these laws and to allow us to figure and collect the right

not use Forms 8804, 8805, and 8813.

amount of tax.

Instead, under the general rule for

The time needed to complete and file these forms will vary depending on

publicly traded partnerships, it must (a)

individual circumstances. The estimated average times are:

withhold on distributions to its foreign

partners, (b) comply with the regulations

Form

8804

8805

8813

under section 1461 and Regulations

Recordkeeping

59 min.

59 min.

26 min.

section 1.6302-2, AND (c) use Forms

1042 and 1042-S, Annual Withholding

Learning about the

law or the form

56 min.

54 min.

49 min.

Tax Return for U.S. Source Income of

Foreign Persons; and Foreign Person’s

Preparing the form

31 min.

17 min.

16 min.

U.S. Source Income Subject to

Copying, assembling,

Withholding.

and sending the form

to the IRS

20 min.

17 min.

10 min.

When To File

If you have comments concerning the accuracy of these time estimates or

suggestions for making these forms simpler, we would be happy to hear from you.

Forms 8804 and 8805

You can write to both the Internal Revenue Service, Attention: Tax Forms

Generally, file on or before the 15th day

Committee, PC:FP, Washington, DC 20224; and the Office of Management and

of the 4th month following the close of

Budget, Paperwork Reduction Project (1545-1119), Washington, DC 20503. DO

the partnership’s tax year. However, a

NOT send the tax forms to either of these offices. Instead, see Where To File

partnership that consists entirely of

below.

nonresident alien partners must file on or

before the 15th day of the 6th month

General Instructions

following the close of the partnership’s

page 4. Any U.S. person that was

tax year.

erroneously made subject to the

withholding tax would also receive Form

File Forms 8804 and 8805 separately

Purpose of Forms

8805 from a partnership and should

from Form 1065 and its attachments.

attach it to his or her income tax return.

Use Forms 8804, 8805, and 8813 to pay

If you need more time, you may file

and report section 1446 withholding tax

Use Form 8813, Partnership

Form 2758, Application for Extension of

based on effectively connected taxable

Withholding Tax Payment (Section 1446),

Time To File Certain Excise, Income,

income allocable to foreign partners.

to pay the withholding tax under section

Information, and Other Returns, to

1446 to the IRS. Form 8813 must

Use Form 8804, Annual Return for

request an extension of time to file Form

accompany each payment of section

Partnership Withholding Tax (Section

8804. However, Form 2758 does not

1446 tax made during the partnership’s

1446), to report the total liability under

extend the time for payment of tax.

section 1446 for the partnership’s tax

tax year.

Form 8813

year. Form 8804 is also a transmittal

form for Form(s) 8805.

Who Must File

File on or before the 15th day of the 4th,

Use Form 8805, Foreign Partner’s

6th, 9th, and 12th months of the

All partnerships with effectively

Information Statement of Section 1446

partnership’s tax year for U.S. income

connected gross income allocable to a

Withholding Tax, to show the amount of

tax purposes.

foreign partner in any tax year must file

effectively connected taxable income

Forms 8804 and 8805 whether or not

and the total tax credit allowed to the

Where To File

distributions were made during the

foreign partner for the partnership’s tax

partnership’s tax year. The partnership

File Forms 8804, 8805, and 8813 with:

year.

may designate a person to file for it. The

Internal Revenue Service Center

File a separate Form 8805 for each

partnership, or person it designates,

Philadelphia, PA 19255.

foreign partner even if no section 1446

must file these forms whether or not the

withholding tax was paid. Attach Copy A

partnership has a withholding tax liability

Requirement To Make

of each Form 8805 to the Form 8804

under section 1446.

Withholding Tax Payments

filed with the IRS.

A publicly traded partnership must file

Foreign partners must attach Form

these forms only if it elects to pay

A foreign or domestic partnership that

8805 to their U.S. income tax returns to

section 1446 withholding tax based on

has effectively connected taxable

claim a credit for their shares of the

effectively connected taxable income

income allocable to a foreign partner

section 1446 tax withheld by the

allocable to its foreign partners, instead

must pay a withholding tax equal to the

partnership. A foreign partnership that

of withholding the tax on distributions to

applicable percentage of the effectively

receives Form 8805 should see the

connected taxable income that is

instructions for Tiered Partnerships on

allocable to its foreign partners.

Cat. No. 10393W

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8