Form Boe-571-L - Business Property Statement - 2005 Page 2

ADVERTISEMENT

BOE-571-L (SIB) Rev. 9 (8-04)

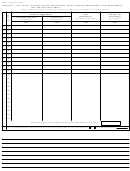

SCHEDULE A - COST DETAIL: EQUIPMENT (Do not include property reported in PART III)

Include expensed equipment and fully depreciated items. Include sales or use tax, freight and installation costs. Attach schedules as needed. Line 18, 31,

33, & 42 “Prior” — Report detail by year(s) of acquisition on a separate schedule.

ASSESSOR’S USE ONLY

1.

2.

3.

4.

LineNo. Calendar

Calendar

Machinery and Equipment for

Other Equipment

Office Furniture and Equipment

Tools, Molds, Dies and Jigs

Yr. Of Acq.

Year of Acq.

Industry, Profession or Trade

Describe _______________

(Do not include licensed vehicles)

COST

COST

COST

COST

11

2004

2004

12

2003

2003

13

2002

2002

14

2001

2001

15

2000

2000

16

1999

1999

17

1998

1998

18

1997

Prior

19

1996

Total

5a. Computers. Component cost

20

1995

Calendar

of $25,000.00 or less

21

1994

Year of Acq.

22

1993

COST

23

1992

2004

24

1991

2003

25

1990

2002

26

1989

2001

27

1988

2000

28

1987

1999

29

1986

1998

30

1985

1997

31

1984

Prior

32

1983

Total

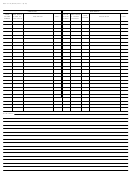

5b. Computers. Component cost of

33

Prior

Calendar

$25,000.01 to $500,000.00

34

Total

Year of Acq.

COST

Add TOTALS on 19, 32,34,43,46 and any additional schedules.

35

2004

ENTER HERE AND ON PAGE 1, PART II, LINE 2

2003

36

REMARKS:

2002

37

2001

38

2000

39

1999

40

1998

41

1997

42

Prior

43

Total

44

5c. Computers. Provide total cost of components costing

$500,000.01 or more and attach detailed schedule by year

45

of acquisition.

46

TOTAL COST:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5