Form Boe-571-L - Business Property Statement - 2005 Page 4

ADVERTISEMENT

BOE-571-D (FRONT) REV. 7 (8-04)

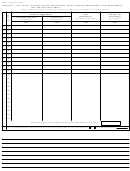

SUPPLEMENTAL SCHEDULE FOR REPORTING

MONTHLY ACQUISITIONS AND DISPOSALS OF

PROPERTY REPORTED ON SCHEDULE B OF THE

BUSINESS PROPERTY STATEMENT

OWNER NAME

MAILING ADDRESS

LOCATION OF PROPERTY

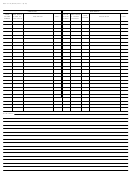

INSTRUCTIONS

Report all acquisitions and disposals reported in Columns 1, 2, 3, or 4 on Schedule B for the period January 1, 2004 through

December 31, 2004. Indicate the applicable column number in the space provided.

ADDITIONS – Describe and enter the total acquisition cost(s), including excise, sales, and use taxes, freight-in, and installation

charges, by month of acquisition; transfers-in should also be included. The former property address and date of transfer should be

reported, as well as original date and cost(s) of acquisition.

Only completed projects should be reported here (e.g., the date the property becomes functional and/or operational, otherwise it

should be reported as construction-in-progress).

Identify completed construction that was reported as construction in progress on your 2004 property statement. Describe the item(s)

and cost(s), as previously reported, on a separate schedule and attach to Form BOE-571-D.

DISPOSALS – Information on this property should include the disposal date, method of disposal (transfer, scrapped, abandoned, sold,

etc.) and names and addresses of purchasers when items are either sold or transferred.

ADDITIONS

DISPOSALS

F R O M

ENTER MONTH

F R O M

ENTER MONTH

Y E A R

C O L U M N

& Y E A R O F

D E S C R I P T I O N

C O S T

C O L U M N

& Y E A R O F

D E S C R I P T I O N

C O S T

A C Q U I R E D

N U M B E R

A C Q U I S I T I O N

N U M B E R

D I S P O S A L

THIS STATEMENT SUBJECT TO AUDIT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5