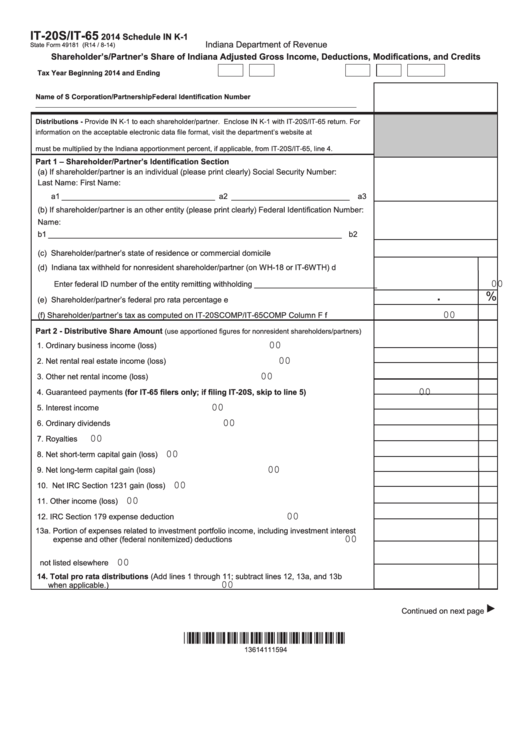

IT-20S/IT-65

2014 Schedule IN K-1

Indiana Department of Revenue

State Form 49181 (R14 / 8-14)

Shareholder’s/Partner’s Share of Indiana Adjusted Gross Income, Deductions, Modifications, and Credits

Tax Year Beginning

2014 and Ending

Name of S Corporation/Partnership

Federal Identification Number

Distributions - Provide IN K-1 to each shareholder/partner. Enclose IN K-1 with IT-20S/IT-65 return. For

information on the acceptable electronic data file format, visit the department’s website at

Pro rata amounts for lines 1 through 26 of any nonresident shareholder/partner

must be multiplied by the Indiana apportionment percent, if applicable, from IT-20S/IT-65, line 4.

Part 1 – Shareholder/Partner’s Identification Section

(a) If shareholder/partner is an individual (please print clearly)

Social Security Number:

Last Name:

First Name:

a1 ___________________________________

a2 ___________________________

a3

(b) If shareholder/partner is an other entity (please print clearly)

Federal Identification Number:

Name:

b1 ___________________________________________________________________

b2

(c) Shareholder/partner’s state of residence or commercial domicile ............................................c1

(d) Indiana tax withheld for nonresident shareholder/partner (on WH-18 or IT-6WTH) ................. d

00

Enter federal ID number of the entity remitting withholding ____________________________

.

%

(e) Shareholder/partner’s federal pro rata percentage ................................................................. e

00

(f) Shareholder/partner’s tax as computed on IT-20SCOMP/IT-65COMP Column F .................. f

Part 2 - Distributive Share Amount

(use apportioned figures for nonresident shareholders/partners)

00

1. Ordinary business income (loss) ....................................................................................................

00

2. Net rental real estate income (loss) ...............................................................................................

00

3. Other net rental income (loss) ........................................................................................................

00

4. Guaranteed payments (for IT-65 filers only; if filing IT-20S, skip to line 5) ..............................

00

5. Interest income ...............................................................................................................................

00

6. Ordinary dividends .........................................................................................................................

00

7. Royalties ......................................................................................................................................

00

8. Net short-term capital gain (loss) ..................................................................................................

00

9. Net long-term capital gain (loss) ....................................................................................................

00

10. Net IRC Section 1231 gain (loss) ..................................................................................................

00

11. Other income (loss) .......................................................................................................................

00

12. IRC Section 179 expense deduction ..............................................................................................

13a. Portion of expenses related to investment portfolio income, including investment interest

00

expense and other (federal nonitemized) deductions ..................................................................

13b.Other information from line 20 of federal K-1 related to investment interest and expenses

00

not listed elsewhere .....................................................................................................................

14. Total pro rata distributions (Add lines 1 through 11; subtract lines 12, 13a, and 13b

00

when applicable.) ...........................................................................................................................

Continued on next page

*13614111594*

13614111594

1

1 2

2