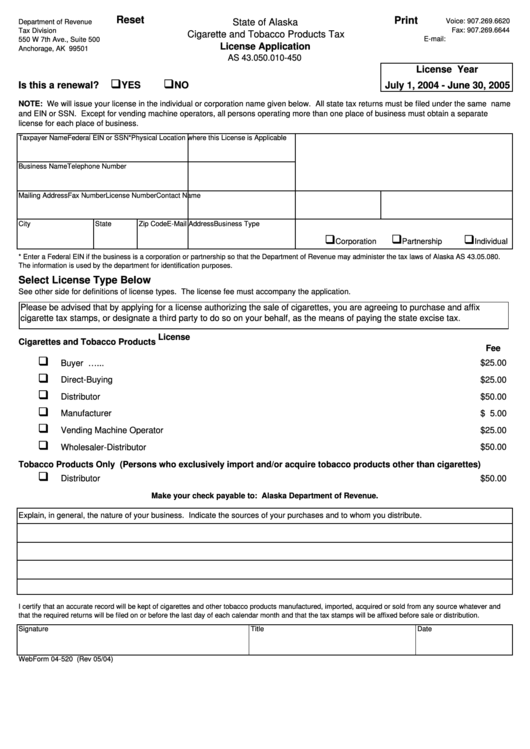

Reset

Print

State of Alaska

Voice: 907.269.6620

Department of Revenue

Fax: 907.269.6644

Tax Division

Cigarette and Tobacco Products Tax

E-mail:

550 W 7th Ave., Suite 500

License Application

Anchorage, AK 99501

AS 43.050.010-450

License Year

q

q

Is this a renewal?

YES

NO

July 1, 2004 - June 30, 2005

NOTE: We will issue your license in the individual or corporation name given below. All state tax returns must be filed under the same name

and EIN or SSN. Except for vending machine operators, all persons operating more than one place of business must obtain a separate

license for each place of business.

Taxpayer Name

Federal EIN or SSN*

Physical Location where this License is Applicable

Business Name

Telephone Number

Mailing Address

Fax Number

License Number

Contact Name

City

State

Zip Code

E-Mail Address

Business Type

q

q

q

Corporation

Partnership

Individual

* Enter a Federal EIN if the business is a corporation or partnership so that the Department of Revenue may administer the tax laws of Alaska AS 43.05.080.

The information is used by the department for identification purposes.

Select License Type Below

See other side for definitions of license types. The license fee must accompany the application.

Please be advised that by applying for a license authorizing the sale of cigarettes, you are agreeing to purchase and affix

cigarette tax stamps, or designate a third party to do so on your behalf, as the means of paying the state excise tax.

License

Cigarettes and Tobacco Products

Fee

q

Buyer ..........................................................................................................................................................................................

$25.00

q

Direct-Buying Retailer..................................................................................................................................................................

$25.00

q

Distributor ...................................................................................................................................................................................

$50.00

q

Manufacturer ...............................................................................................................................................................................

$ 5.00

q

Vending Machine Operator .........................................................................................................................................................

$25.00

q

Wholesaler-Distributor ................................................................................................................................................................

$50.00

Tobacco Products Only (Persons who exclusively import and/or acquire tobacco products other than cigarettes)

q

Distributor ...................................................................................................................................................................................

$50.00

Make your check payable to: Alaska Department of Revenue.

Explain, in general, the nature of your business. Indicate the sources of your purchases and to whom you distribute.

I certify that an accurate record will be kept of cigarettes and other tobacco products manufactured, imported, acquired or sold from any source whatever and

that the required returns will be filed on or before the last day of each calendar month and that the tax stamps will be affixed before sale or distribution.

Signature

Title

Date

WebForm 04-520 (Rev 05/04)

1

1 2

2