Form 0405-520 - State Of Alaska Cigarette And Tobacco Products Tax License Application

ADVERTISEMENT

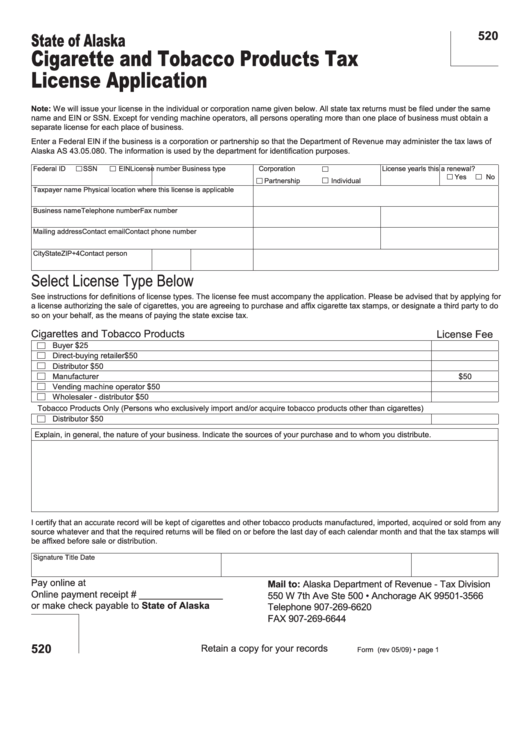

State of Alaska

520

Cigarette and Tobacco Products Tax

License Application

Note: We will issue your license in the individual or corporation name given below. All state tax returns must be filed under the same

name and EIN or SSN. Except for vending machine operators, all persons operating more than one place of business must obtain a

separate license for each place of business.

Enter a Federal EIN if the business is a corporation or partnership so that the Department of Revenue may administer the tax laws of

Alaska AS 43.05.080. The information is used by the department for identification purposes.

Federal ID

SSN

EIN

License number

Business type

Corporation

License year

Is this a renewal?

Yes

No

Partnership

Individual

Taxpayer name

Physical location where this license is applicable

Business name

Telephone number

Fax number

Mailing address

Contact email

Contact phone number

City

State

ZIP+4

Contact person

Select License Type Below

See instructions for definitions of license types. The license fee must accompany the application. Please be advised that by applying for

a license authorizing the sale of cigarettes, you are agreeing to purchase and affix cigarette tax stamps, or designate a third party to do

so on your behalf, as the means of paying the state excise tax.

Cigarettes and Tobacco Products

License Fee

Buyer

$25

Direct-buying retailer

$50

Distributor

$50

Manufacturer

$50

Vending machine operator

$50

Wholesaler - distributor

$50

Tobacco Products Only (Persons who exclusively import and/or acquire tobacco products other than cigarettes)

Distributor

$50

Explain, in general, the nature of your business. Indicate the sources of your purchase and to whom you distribute.

I certify that an accurate record will be kept of cigarettes and other tobacco products manufactured, imported, acquired or sold from any

source whatever and that the required returns will be filed on or before the last day of each calendar month and that the tax stamps will

be affixed before sale or distribution.

Signature

Title

Date

Pay online at

Mail to: Alaska Department of Revenue - Tax Division

Online payment receipt # ________________

550 W 7th Ave Ste 500 • Anchorage AK 99501-3566

or make check payable to State of Alaska

Telephone 907-269-6620

FAX 907-269-6644

dor.tax.cigarette@alaska.gov

520

Retain a copy for your records

Form 0405-520.webform (rev 05/09) • page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1