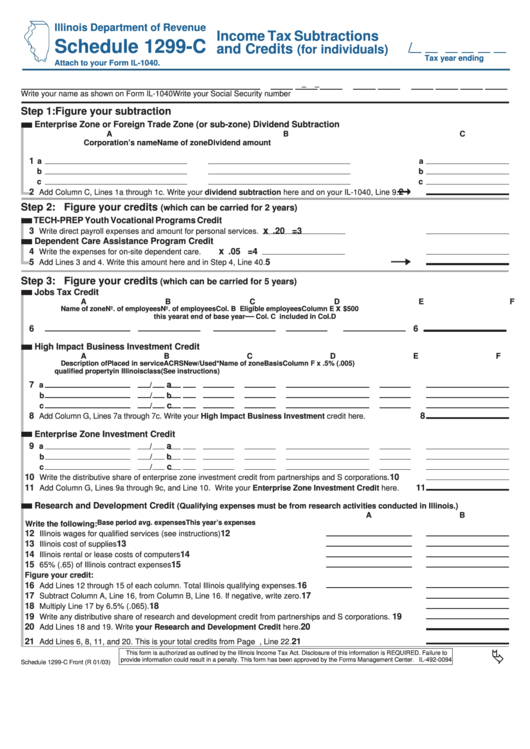

Schedule 1299-C- Income Tax Subtractions And Credits (For Individuals)

ADVERTISEMENT

Illinois Department of Revenue

Income Tax Subtractions

Schedule 1299-C

/

and Credits

(for individuals)

Tax year ending

Attach to your Form IL-1040.

–

–

Write your name as shown on Form IL-1040

Write your Social Security number

Step 1: Figure your subtraction

Enterprise Zone or Foreign Trade Zone (or sub-zone) Dividend Subtraction

A

B

C

Corporation’s name

Name of zone

Dividend amount

1

a

a

b

b

c

c

2

2

Add Column C, Lines 1a through 1c. Write your dividend subtraction here and on your IL-1040, Line 9.

Step 2: Figure your credits

(which can be carried for 2 years)

TECH-PREP Youth Vocational Programs Credit

x

3

.20 =

3

Write direct payroll expenses and amount for personal services.

Dependent Care Assistance Program Credit

x

4

.05 =

4

Write the expenses for on-site dependent care.

5

5

Add Lines 3 and 4. Write this amount here and in Step 4, Line 40.

Step 3: Figure your credits

(which can be carried for 5 years)

Jobs Tax Credit

A

B

C

D

E

F

x

Name of zone

No. of employees

No. of employees

Col. B

Eligible employees

Column E

$500

—

this year

at end of base year

Col. C

included in Col.D

6

6

High Impact Business Investment Credit

A

B

C

D

E

F

G

Description of

Placed in service

ACRS

New/Used*

Name of zone

Basis

Column F x .5% (.005)

qualified property

in Illinois

class (See instructions)

7

a

a

/

b

/

b

c

c

/

8

8

Add Column G, Lines 7a through 7c. Write your High Impact Business Investment credit here.

Enterprise Zone Investment Credit

9

a

a

/

b

/

b

c

c

/

10

10

Write the distributive share of enterprise zone investment credit from partnerships and S corporations.

11

11

Add Column G, Lines 9a through 9c, and Line 10. Write your Enterprise Zone Investment Credit here.

Research and Development Credit

(Qualifying expenses must be from research activities conducted in Illinois.)

A

B

Base period avg. expenses

This year’s expenses

Write the following:

12

12

Illinois wages for qualified services (see instructions)

13

13

Illinois cost of supplies

14

14

Illinois rental or lease costs of computers

15

15

65% (.65) of Illinois contract expenses

Figure your credit:

16

16

Add Lines 12 through 15 of each column. Total Illinois qualifying expenses.

17

17

Subtract Column A, Line 16, from Column B, Line 16. If negative, write zero.

18

18

Multiply Line 17 by 6.5% (.065).

19

19

Write any distributive share of research and development credit from partnerships and S corporations.

20

20

Add Lines 18 and 19. Write your Research and Development Credit here.

21

21

Add Lines 6, 8, 11, and 20. This is your total credits from Page 1.Write here and on Page 2, Line 22.

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to

provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-0094

Schedule 1299-C Front (R 01/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2