Declaration Of Estimated Tax For Year 2012 - Village Of Malinta Page 2

ADVERTISEMENT

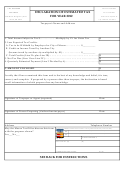

SCHEDULE C

NOTE - IF column A is used, disregard Column B

COLUMN A

COLUMN B

As shown by

Allocable To

Federal Return

This Community

1. Net Profit or Loss per your Federal Income Tax Return (attach income statement)------------------- $

$

2. Add items not deductible under Tax Ordinance (Schedule X)----------------------------------------------- $

3. Deduct items not taxable under Tax Ordinance (Schedule X)----------------------------------------------- $

4. Adjusted Net Profit------------------------------------------------------------------------------------------------------ $

$

5. ________%(as determined by Business Allocation Formula)of Line4, Col. A.-------------------------- $

xxxxx

6. Net Profits - Line 5, Column A; or Line 4, Column B (Enter on Line 2 – Page 1)----------------------- $

$

SCHEDULE X

ADJUSTMENT OF NET PROFIT OR LOSS LINE 1, SCHEDULE C ABOVE, TO EXCLUDE INCOME NOT

TAXABLE AND EXPENSES NOT ALLOWABLE, UNDER INCOME TAX ORDINANCE

Schedule X entries are allowed only to the extent directly included in determination of net profits as shown in your Federal Return.

Items Not Deductible - ADD

Items Not Taxable – DEDUCT

a. Withdraw by proprietor or partners, if

included in any expense accounts------

$

e. Capital Gains----------------------------------------

$

b. All income taxes paid or accrued--------

$

c. Net operating loss carry-forward, from

Other - attach explanation citing legal basis for

Federal Return------------------------------

$

f.

deduction--------------------------------------------

$

d. Capital losses-------------------------------

$

Total Additions

Total Deductions

(enter on line 2, Schedule C above)----

$

(enter on line 3, Schedule C above)-------------

$

SCHEDULE G – INCOME FROM RENTS not included in Schedule C above

(Copy from Federal Income Tax Schedule)

Location of Property

Amt. Rent

Depreciation

Repairs

Other expense

Net Income

$

$

$

$

$

Total:

$

$

$

$

$

(If total gross monthly rental from all properties does not exceed $100.00 DO NOT show any Net Income here)

$

a.

b.

Located

Located in

Percentage

Business Allocation Formula

Everywhere

Municipality

(b divided by a)

Step 1.

Average Value of Real & Tangible Personal Property----

$

$

xxxxx

Gross Annual Rentals multiplied by 8-------------------------

$

$

xxxxx

Total Step 1----------------------------------------------------------

$

$

%

Step 2.

Net Sales-------------------------------------------------------------

$

$

%

Step 3.

Wages, Salaries Paid---------------------------------------------

$

$

%

Step 4.

Total Percentages

%

Step 5.

Average percentage (Divide total percentages by number of percentages used. Carry to line 5 - Schedule C, above)

%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2