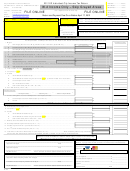

Form Ir-Ez - Individual City Income Tax Return - 2011 Page 2

ADVERTISEMENT

Section A – Additional Taxpayer Information

NOTE:

UNLESS ACCOMPANIED BY COPIES OF APPROPRIATE FEDERAL SCHEDULES OR FORMS

AND PAYMENT OF THE TOTAL AMOUNT DUE (LINE 15) THIS FORM IS NOT A LEGAL FINAL RETURN.

Has your federal tax liability for any prior year been changed this year as a result of an examination by the internal revenue service?

YES

NO

If yes, has an amended return been filed for such year or years?

YES

NO

Did you receive or apply for a refund from any other municipality in 2011?

YES

NO

If yes, give name of municipality _________________________________________________ amount of refund _______________ year refund was for ______________.

Section B – Part Year Resident W-2 Wages & Withholding Credit Worksheet

If there are discrepancies in the calculations below (such as the employer has not withheld correctly) additional tax may be due.

A single W-2 showing withholding for more than one city cannot be calculated on this worksheet. Please call for assistance.

A

B

C

D

E

F

G

H

H-1

H-2

1.

2.

3.

4.

5.

6.

TOTAL

Carry Totals to Front of Return:

Taxable Wages (Column F) to Line 1A

(Sum Lines 1 thru 6 Column F & H)

Withholding Credit (Column H) to Line 5B

1A

***5B

**West Milton & Phillipsburg Only: For Lines 1 through 6, Compare Column H to

*Hamilton, New Miami, Eaton and BC Annex Only: For Lines 1 through 6, Compare

Column H-2: circle the lesser of the two amounts for other city withholding or the

Column H to Column H-1, circle the lesser of the two amounts. Next Total all of the

largest amount for resident city withholding. Next, Total all of the circled amounts

circled amounts & put the total at the bottom of Column H.

together & put the total at the bottom of Column H.

***For Part Year Resident Only: Carry the TOTAL Withholding Credit (including resident city and/or another city withholding) to Line 5B on front of return.

Section C – Other Taxable Income Profit or (Loss)

Do You Have Employees Working in This City?

Do You Use Sub-Contract Labor to Perform Work in This City?

No Yes,

February 29, 2012

No Yes,

February 29, 2012

Employee W-2’s Must Be Submitted to this Office By

1099’s Must Be Submitted to this Office By

Attach All Federal Schedules

If TOTAL is:

Supporting Profit or (Loss) Below

Schedule C

- Business Income

Profit

All Cities: Enter Total Profit on Line 2A of return.

Total Profit (Loss) from Line 31 Schedule C

$

Schedule E

– Rental Income

Loss

Total Profit (Loss) from Line 22 Schedule E

$

Hamilton & Butler County Annex: Loss may be carried forward 3 years for

Hamilton and BC Annex. A net operating loss by a business or profession

Schedule F

– Farm

cannot be deducted from W-2 Wages. Enter Total Loss on Line 2B of return.

Total Profit (Loss) from Line 36 Schedule F

$

Eaton, West Milton & Phillipsburg: No loss carry forward is allowed. A loss is

allowed against W-2 wages, but is limited to the amount of W-2 Wages that have

Schedule K-1

– Partnership Income

tax withheld to the resident city or the portion of W-2 Wages that tax is due on to

the resident city. Enter Allowable Loss on Line 2A of return.

Total Profit (Loss)

$

New Miami: Current year Loss may be carried forward for 5 years OR your

TOTAL

current year loss can be deducted against W-2 Wages, but is limited to the

amount of W-2 Wages that have tax withheld to the resident city or the portion of

$

Read Right Hand Column for Instructions to Carry Profit or

W-2 Wages that tax is due on to the resident city. Enter Allowable Loss on Line

(Loss) to front of Return.

2A to apply against W-2 wages OR Enter Total Loss on Line 2B to carry forward.

If only a portion of the Schedule Profit or (Loss) is taxable to the city, please note the percentage taxable to this city on federal schedule and input the reduced figure in the

appropriate box above. See Instructions for further explanation.

City Tax Assistance is Free

Section D – 2011 Short Form

Available on a First Come First Serve Basis

DID YOU HAVE W-2 INCOME?

YES

NO

DID YOU OWN RENTAL PROPERTY?

YES

NO

Office Hours:

DID YOU PARTICIPATE IN A BUSINESS OR

YES

NO

Monday–Friday, 8:30 a.m.-5:00 p.m.

PARTNERSHIP?

FOR HAMILTON AND WEST MILTON RESIDENTS ONLY:

Extended Hours:

DID YOU HAVE GAMBLING WINNINGS?

YES

NO

Saturday April 14, 2012 8:30 a.m. – 12:00 noon

IF ALL ANSWERS ARE NO, PLEASE MARK THEM, SIGN AND

April 13, 16, 17, 2012 8:30 a.m. – 8:00 p.m.

MAIL TO ADDRESS IN UPPER LEFT CORNER OF RETURN.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2