Instructions For Form C-8008 Affiliation Schedule - Consolidated Or Combined Filing

ADVERTISEMENT

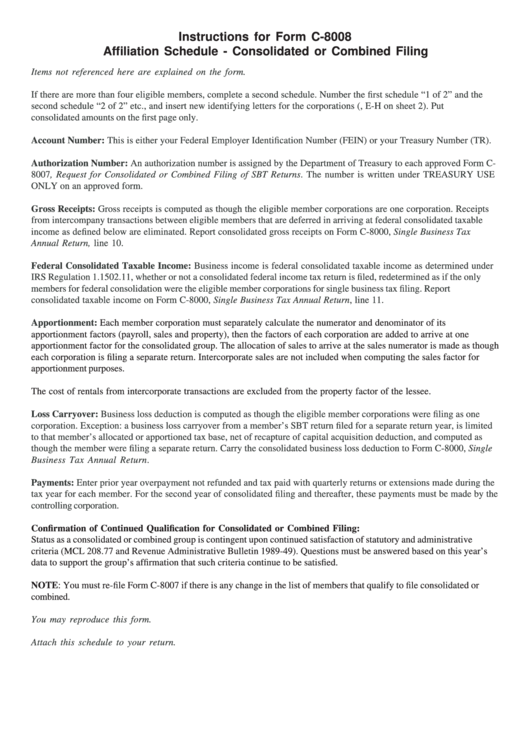

Instructions for Form C-8008

Affiliation Schedule - Consolidated or Combined Filing

Items not referenced here are explained on the form.

If there are more than four eligible members, complete a second schedule. Number the first schedule “1 of 2” and the

second schedule “2 of 2” etc., and insert new identifying letters for the corporations (e.g., E-H on sheet 2). Put

consolidated amounts on the first page only.

Account Number: This is either your Federal Employer Identification Number (FEIN) or your Treasury Number (TR).

Authorization Number: An authorization number is assigned by the Department of Treasury to each approved Form C-

8007, Request for Consolidated or Combined Filing of SBT Returns. The number is written under TREASURY USE

ONLY on an approved form.

Gross Receipts: Gross receipts is computed as though the eligible member corporations are one corporation. Receipts

from intercompany transactions between eligible members that are deferred in arriving at federal consolidated taxable

income as defined below are eliminated. Report consolidated gross receipts on Form C-8000, Single Business Tax

Annual Return, line 10.

Federal Consolidated Taxable Income: Business income is federal consolidated taxable income as determined under

IRS Regulation 1.1502.11, whether or not a consolidated federal income tax return is filed, redetermined as if the only

members for federal consolidation were the eligible member corporations for single business tax filing. Report

consolidated taxable income on Form C-8000, Single Business Tax Annual Return, line 11.

Apportionment:

Each member corporation must separately calculate the numerator and denominator of its

apportionment factors (payroll, sales and property), then the factors of each corporation are added to arrive at one

apportionment factor for the consolidated group. The allocation of sales to arrive at the sales numerator is made as though

each corporation is filing a separate return. Intercorporate sales are not included when computing the sales factor for

apportionment purposes.

The cost of rentals from intercorporate transactions are excluded from the property factor of the lessee.

Loss Carryover: Business loss deduction is computed as though the eligible member corporations were filing as one

corporation. Exception: a business loss carryover from a member’s SBT return filed for a separate return year, is limited

to that member’s allocated or apportioned tax base, net of recapture of capital acquisition deduction, and computed as

though the member were filing a separate return. Carry the consolidated business loss deduction to Form C-8000, Single

Business Tax Annual Return.

Payments: Enter prior year overpayment not refunded and tax paid with quarterly returns or extensions made during the

tax year for each member. For the second year of consolidated filing and thereafter, these payments must be made by the

controlling corporation.

Confirmation of Continued Qualification for Consolidated or Combined Filing:

Status as a consolidated or combined group is contingent upon continued satisfaction of statutory and administrative

criteria (MCL 208.77 and Revenue Administrative Bulletin 1989-49). Questions must be answered based on this year’s

data to support the group’s affirmation that such criteria continue to be satisfied.

NOTE: You must re-file Form C-8007 if there is any change in the list of members that qualify to file consolidated or

combined.

You may reproduce this form.

Attach this schedule to your return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1