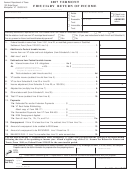

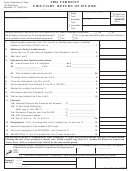

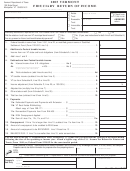

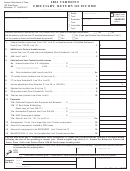

Form Fi-161 - Fiduciary Return Of Income - 2004 Page 3

ADVERTISEMENT

SCHEDULE D.

VT CREDIT FOR TAX PAID TO ANOTHER STATE OR CANADIAN PROVINCE.*

FOR RESIDENTS AND PART-YEAR RESIDENTS ONLY

* You must complete a separate Schedule D for each credit claimed.

_

30a. ______________________________

30b. ____________________________ = 30c. _______________________

Total income taxed in another state or

Capital Gains Exclusion (40% of capital

Income eligible for credit (Line 30a

Canadian province and also subject to

gains reported to other state or

minus Line 30b)

VT tax

province)

31. Total income (from Federal Form 1041, Line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31.

32. VT Fiduciary Income Tax (from Line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32.

33. Computed tax credit: Divide Line 30c by Line 31 and multiply by Line 32

Line 30c

x Line 32 ______________

Line 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33.

34. Amount of TAX due and paid to other state or Canadian province on

income on Line 30a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34.

35. Total Other States Credit:

Enter the lesser of Line 33 or 34 here and on Line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . 35.

Name of state or Canadian province

COPIES OF NONRESIDENT RETURNS MUST BE ATTACHED

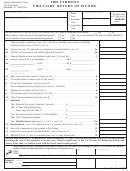

SCHEDULE E. NONRESIDENTS AND PART-YEAR RESIDENTS must complete this section

A. Federal Amount $

B. VT Portion $

INCOME

36. Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36.

37. Total ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37.

38. Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38.

39. Capital gain (or loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39.

40. Rents, royalties, partnerships, S Corporations (+ LLCs), other

estates and trusts, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40.

41. Farm income (or loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41.

42. Ordinary gain (or loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42.

43. Other income (list type of income) . . . . . . . . . . . . . . . . . . . . . . . . . . 43.

44. Income from non-VT municipal obligations

(Schedule A, Line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44.

45. Total income (add Lines 36 through 44) . . . . . . . . . . . . . . . . . . . . . . 45.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

46. Non-VT income (Column A, Line 45 less Column B, Line 45).

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

Enter here and on Schedule C, Line 27 . . . . . . . . . . . . . . . . . . . . . . 46.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

Dates of VT residency in 2004: From: ________________________to: _______________________

Name of resident state(s) during period of nonresidency in VT:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3