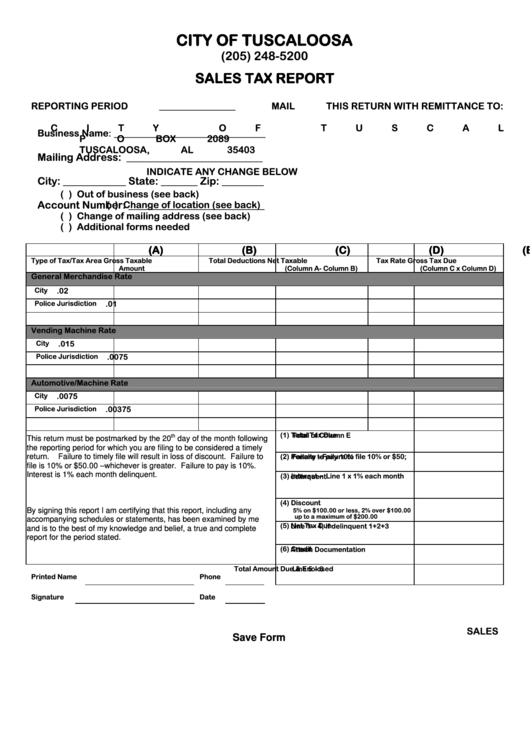

CITY OF TUSCALOOSA

(205) 248-5200

SALES TAX REPORT

REPORTING PERIOD ________________

MAIL THIS RETURN WITH REMITTANCE TO:

CITY OF TUSCALOOSA, REVENUE DEPT.

Business Name

: _____________________________

P O BOX 2089

TUSCALOOSA, AL 35403

Mailing Address: __________________________

INDICATE ANY CHANGE BELOW

City: ____________ State: _______ Zip: ________

( ) Out of business (see back)

Account Number: __________________________

( ) Change of location (see back)

( ) Change of mailing address (see back)

( ) Additional forms needed

(A)

(B)

(C)

(D)

(E)

Type of Tax/Tax Area

Gross Taxable

Total Deductions

Net Taxable

Tax Rate

Gross Tax Due

Amount

(Column A- Column B)

(Column C x Column D)

General Merchandise Rate

City

.02

Police Jurisdiction

.01

Vending Machine Rate

City

.015

Police Jurisdiction

.0075

Automotive/Machine Rate

City

.0075

Police Jurisdiction

.00375

(1) Total Tax Due

th

This return must be postmarked by the 20

day of the month following

Total of Column E

the reporting period for which you are filing to be considered a timely

(2) Penalty --Failure to file 10% or $50;

return.

Failure to timely file will result in loss of discount. Failure to

Failure to pay 10%

file is 10% or $50.00 –whichever is greater. Failure to pay is 10%.

Interest is 1% each month delinquent.

(3) Interest – Line 1 x 1% each month

delinquent

(4) Discount

5% on $100.00 or less, 2% over $100.00

By signing this report I am certifying that this report, including any

up to a maximum of $200.00

accompanying schedules or statements, has been examined by me

(5) Net Tax Due

and is to the best of my knowledge and belief, a true and complete

Line 1 – 4, if delinquent 1+2+3

report for the period stated.

(6) Credit

Attach Documentation

Total Amount Due & Enclosed

Printed Name

Phone

Line 5 – 6

Signature

Date

SALES

Save Form

1

1 2

2