PRIVACY ACT

A Privacy Act Statement required by 5 U.S.C. 552a(e)(3) stating our authority for soliciting and collecting the information from your check,

and explaining the purposes and routine uses which will be made of your check information, is available at

, or call toll free at (877)882-3277 to obtain a copy by mail. Furnishing the check

information is voluntary, but a decision not to do so may require you to make payment by some other method.

35. ADDITIONAL INSTRUCTIONS (Reference by Item Number)

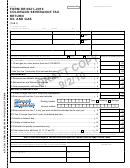

36. ELIGIBILITY FOR COVER OVER

COLUMN 1

COLUMN 2

a. DISTILLED SPIRITS

PROOF GALLONS (92% Rum)

PROOF GALLONS (other)

TAXES PAID ON PRODUCTS MEETING 50%

OTHER

VALUE ADDED REQUIREMENT

b. WINE, BEER, TOBACCO PRODUCTS,

$

$

OR CIGARETTE PAPERS AND TUBES

37. NUMBER OF LARGE CIGARS UPON WHICH TAX WAS COMPUTED, BY STATISTICAL CLASSES

(a) CLASS - A

(b) CLASS - B

(c) CLASS - C

(d) CLASS - D

+

+

+

=

(e) CLASS - E

(f) CLASS - F

(g) CLASS - G

(h) CLASS - H

+

+

+

=

38. RECEIPT OF DISTRICT DIRECTOR (INVESTIGATIONS) PUERTO RICO OPERATIONS

a.

DATE RECEIVED

b. AMOUNT RECEIVED

c. BY TTB OFFICER (Signature and Official Title)

$

INSTRUCTIONS

9. SC

DULE B. Use Schedule B to report adjustments decreasing the amount due

1. PREPARATION AND FILING

(for example, an error in a previous return period that resulted in an overpayment of

(a) DISTILLED SPIRITS, WINE, AND BEER - Prepare in duplicate. The return

tax). Prepayments of tax, claims approved for credit of tax, and other authorized

must cover taxable shipments to the United States plus any other tax liabilities

adjustments must be reported in Schedule B. You may carry over to Schedule B of

incurred or discovered during the tax period. File the original and duplicate with

your next tax return the unused portion of any approved tax credits or adjustments.

remittance covering the full amount of tax, with the District Director

(Investigations) Puerto Rico Operations, TTB, San Juan, PR (see instruction

10. EXPLANATION OF ADJUSTMENTS. You must fully explain adjustments reported

14 for address). The District Director (Investigations) Puerto Rico Operations

in Schedules A and B. Identify any prepayment by serial number of the tax return on

will acknowledge receipt in Item 38 and return the duplicate copy for your files.

which the tax was prepaid. Identify approved claims by claim number. In all other

cases, you must enter, as a minimum, the date of the transaction (the date of an error,

(b) TOBACCO PRODUCTS, AND CIGARETTE PAPERS AND TUBES - Prepare

the date a shortage was found, etc.), the identity and quantity of the product involved

in duplicate. The return must cover taxable shipments to the United States plus

in the adjustment, and the reason for the adjustment. If necessary, use the space

any other tax liabilities incurred or discovered during the tax period. File the original

above and/or attach a separate sheet to explain adjustments fully.

and duplicate with remittance covering the full amount of tax, with the District

Director (Investigations) Puerto Rico Operations, TTB, San Juan, PR (see

11. INTEREST. The law provides for the payment of interest on underpayments and

instruction 14 for address). After acknowledging receipt in Item 38, the District

overpayments of tax. Interest, if applicable, will be computed at the rate

Director will retain the original and return the duplicate copy to the taxpayer.

prescribed by 26 U.S.C. 6621 and reported as a separate entry in Schedule A or

B. To avoid paying interest on unexplained shortages of bottled distilled spirits,

2. A separate TTB F 5000.25 must be prepared for each premises from which you

you must report the shortage on the tax return covering the period in which you

make shipments to the United States subject to tax.

discovered the shortage. Interest is not allowed on adjustments involving the

3. TTB F 5000.25 must be used as both a prepayment tax return and a deferred

prepayment of tax or approved claims for credit of tax (unless the approved claim

payment tax return.

specifically authorized such interest).

4. ITEM 1. Begin with January "1" of each year. Use a separate series of numbers

Compute the interest on underpayments from the due date of the return in error to

with the prefix "P" to designate prepayment returns. Begin with "P-1" to designate

the date of payment. Compute the interest on overpayments from the date of

the first prepayment return filed on or after January 1 of each year.

overpayment to the due date of the return on which the credit is taken.

5. ITEM 6. Enter your employer identification number here and on all checks or

12. Enter "NONE" in Schedule A or Schedule B if there is no transaction.

money orders which accompany your return. If you have not been assigned an

13. Item 36. DISTILLED SPIRITS- Indicate in column 1 the total proof gallons, other

employer identification number, you must obtain and file Form SS-4 with your local

than articles for which drawback will be claimed under 26 U.S.C. 5134, in which

Internal Revenue Service office.

at least 92 percent of the alcoholic content is rum. In column 2 show the total

6. If this form contains pre-printed information in items 6, 7, or 8, and the information

proof gallons of all other spirits.

is incorrect, make the necessary corrections by crossing out any errors and

WINE, BEER, TOBACCO PRODUCTS, AND CIGARETTE PAPERS AND

printing the correct information in the same area. If there is no pre-printed

TUBES. Indicate in column l the total amount of excise taxes entitled for cover over

information in these areas, print or type the required information in the spaces

in which the product meets the 50 percent value added requirement under 26

provided.

U.S.C. 7652(d)(1). In column 2 show the total of all other taxes.

7. LINES 9-21. Show on the appropriate line or lines the amount of tax being

14. Payment must accompany this form except when the payment is by electronic

prepaid or, if the return covers a tax return period, the tax liability incurred during

funds transfer (EFT). Send payment to:

the period. If the return covers a tax return period, you must include at lines 9-16

all tax liabilities incurred during the period even if you have already prepaid the tax.

DISTRICT DIRECTOR (INVESTIGATIONS) PUERTO RICO OPERATIONS

(You will show prepayments in Schedule B as adjustments decreasing the

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU

STE 310 TORRE CHARDON

amount due).

350 CARLOS CHARDON AVE

8. SCHEDULE A. Use Schedule A to report adjustments increasing the amount

SAN JUAN, PR 00918-2124

due (for example, an error in a previous return period that resulted in an

underpayment of tax).

TTB F 5000.25 (0 /20

)

Page 2 of

1

1 2

2