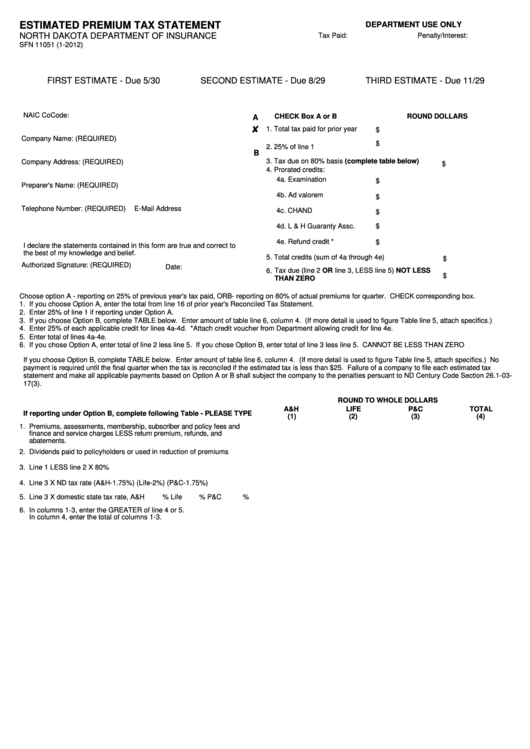

ESTIMATED PREMIUM TAX STATEMENT

DEPARTMENT USE ONLY

Penalty/Interest:

NORTH DAKOTA DEPARTMENT OF INSURANCE

Tax Paid:

SFN 11051 (1-2012)

FIRST ESTIMATE - Due 5/30

SECOND ESTIMATE - Due 8/29

THIRD ESTIMATE - Due 11/29

NAIC CoCode:

CHECK Box A or B

ROUND DOLLARS

A

1. Total tax paid for prior year

$

Company Name: (REQUIRED)

$

2. 25% of line 1

B

3. Tax due on 80% basis (complete table below)

Company Address: (REQUIRED)

$

4. Prorated credits:

4a. Examination

$

Preparer's Name: (REQUIRED)

4b. Ad valorem

$

Telephone Number: (REQUIRED)

E-Mail Address

4c. CHAND

$

4d. L & H Guaranty Assc.

$

4e. Refund credit *

$

I declare the statements contained in this form are true and correct to

the best of my knowledge and belief.

5. Total credits (sum of 4a through 4e)

$

Authorized Signature: (REQUIRED)

Date:

6. Tax due (line 2 OR line 3, LESS line 5) NOT LESS

$

THAN ZERO

Choose option A - reporting on 25% of previous year's tax paid, ORB- reporting on 80% of actual premiums for quarter. CHECK corresponding box.

1. If you choose Option A, enter the total from line 16 of prior year's Reconciled Tax Statement.

2. Enter 25% of line 1 if reporting under Option A.

3. If you choose Option B, complete TABLE below. Enter amount of table line 6, column 4. (If more detail is used to figure Table line 5, attach specifics.)

4. Enter 25% of each applicable credit for lines 4a-4d. *Attach credit voucher from Department allowing credit for line 4e.

5. Enter total of lines 4a-4e.

6. If you chose Option A, enter total of line 2 less line 5. If you chose Option B, enter total of line 3 less line 5. CANNOT BE LESS THAN ZERO

If you choose Option B, complete TABLE below. Enter amount of table line 6, column 4. (If more detail is used to figure Table line 5, attach specifics.) No

payment is required until the final quarter when the tax is reconciled if the estimated tax is less than $25. Failure of a company to file each estimated tax

statement and make all applicable payments based on Option A or B shall subject the company to the penalties persuant to ND Century Code Section 26.1-03-

17(3).

ROUND TO WHOLE DOLLARS

A&H

LIFE

P&C

TOTAL

If reporting under Option B, complete following Table - PLEASE TYPE

(1)

(2)

(3)

(4)

1.

Premiums, assessments, membership, subscriber and policy fees and

finance and service charges LESS return premium, refunds, and

abatements.

2. Dividends paid to policyholders or used in reduction of premiums

3. Line 1 LESS line 2 X 80%

4. Line 3 X ND tax rate (A&H-1.75%) (Life-2%) (P&C-1.75%)

5. Line 3 X domestic state tax rate, A&H

% Life

% P&C

%

6.

In columns 1-3, enter the GREATER of line 4 or 5.

In column 4, enter the total of columns 1-3.

1

1