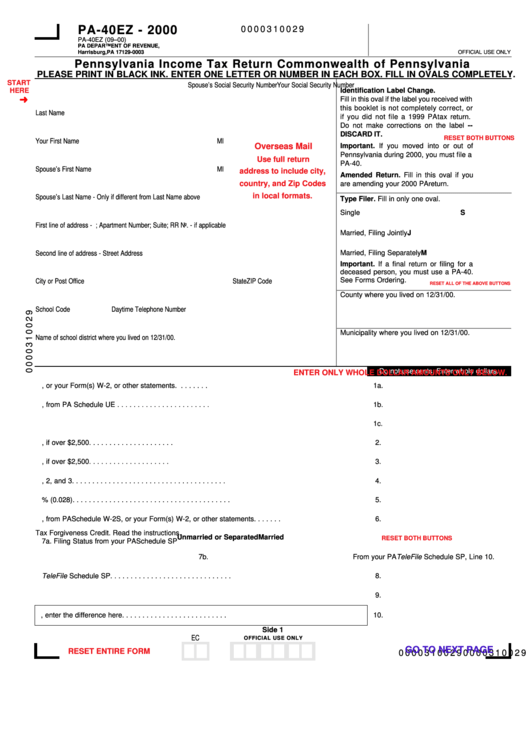

PA-40EZ - 2000

0000310029

PA-40EZ (09–00)

PA DEPARTMENT OF REVENUE,

OFFICIAL USE ONLY

Harrisburg, PA 17129-0003

Pennsylvania Income Tax Return Commonwealth of Pennsylvania

PLEASE PRINT IN BLACK INK. ENTER ONE LETTER OR NUMBER IN EACH BOX. FILL IN OVALS COMPLETELY.

START

Your Social Security Number

Spouse’s Social Security Number

HERE

Identification Label Change.

Fill in this oval if the label you received with

this booklet is not completely correct, or

Last Name

if you did not file a 1999 PA tax return.

Do not make corrections on the label --

DISCARD IT.

RESET BOTH BUTTONS

Your First Name

MI

Overseas Mail

Important. If you moved into or out of

Pennsylvania during 2000, you must file a

Use full return

PA-40.

Spouse’s First Name

MI

address to include city,

Amended Return. Fill in this oval if you

country, and Zip Codes

are amending your 2000 PA return.

in local formats.

Spouse’s Last Name - Only if different from Last Name above

Type Filer. Fill in only one oval.

Single

S

First line of address - P.O. Box; Apartment Number; Suite; RR No. - if applicable

Married, Filing Jointly

J

Second line of address - Street Address

Married, Filing Separately

M

Important. If a final return or filing for a

deceased person, you must use a PA-40.

See Forms Ordering.

City or Post Office

State

ZIP Code

RESET ALL OF THE ABOVE BUTTONS

County where you lived on 12/31/00.

School Code

Daytime Telephone Number

Municipality where you lived on 12/31/00.

Name of school district where you lived on 12/31/00.

Do not use cents. Enter whole dollars.

ENTER ONLY WHOLE DOLLAR AMOUNTS ONLY BELOW.

1a. Gross Compensation from PA Schedule W-2S, or your Form(s) W-2, or other statements. . . . . . . .

1a.

1b. Unreimbursed Employee Business Expenses, from PA Schedule UE . . . . . . . . . . . . . . . . . . . . . . .

1b.

1c. Net Compensation. Subtract Line 1b from Line 1a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c.

2. Interest Income. Complete and enclose a PA Schedule A, if over $2,500. . . . . . . . . . . . . . . . . . . . .

2.

3. Dividend Income. Complete and enclose a PA Schedule B, if over $2,500. . . . . . . . . . . . . . . . . . . .

3.

4. Total PA Taxable Income. Add Lines 1c, 2, and 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. PA Tax Liability. Multiply Line 4 by 2.8% (0.028). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Total PA Tax Withheld, from PA Schedule W-2S, or your Form(s) W-2, or other statements. . . . . . .

6.

Tax Forgiveness Credit. Read the instructions.

Unmarried or Separated

Married

RESET BOTH BUTTONS

7a. Filing Status from your PA Schedule SP

7b. Total Eligibility Income. . . . . . . . . . . . . . . .

7b.

From your PA TeleFile Schedule SP, Line 10.

8. Tax Forgiveness Credit. From your PA TeleFile Schedule SP. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Total Payments and Credits. Add Lines 6 and 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10. TAX DUE. If Line 5 is more than Line 9, enter the difference here. . . . . . . . . . . . . . . . . . . . . . . . . .

10.

Side 1

EC

OFFICIAL USE ONLY

GO TO NEXT PAGE

RESET ENTIRE FORM

0000310029

0000310029

1

1 2

2