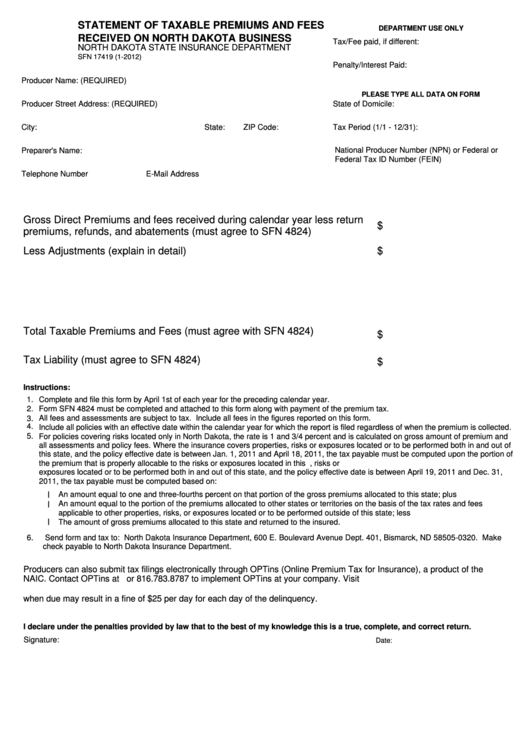

STATEMENT OF TAXABLE PREMIUMS AND FEES

DEPARTMENT USE ONLY

RECEIVED ON NORTH DAKOTA BUSINESS

Tax/Fee paid, if different:

NORTH DAKOTA STATE INSURANCE DEPARTMENT

SFN 17419 (1-2012)

Penalty/Interest Paid:

Producer Name: (REQUIRED)

PLEASE TYPE ALL DATA ON FORM

Producer Street Address: (REQUIRED)

State of Domicile:

City:

State:

ZIP Code:

Tax Period (1/1 - 12/31):

Preparer's Name:

National Producer Number (NPN) or Federal or

Federal Tax ID Number (FEIN)

Telephone Number

E-Mail Address

Gross Direct Premiums and fees received during calendar year less return

$

premiums, refunds, and abatements (must agree to SFN 4824)

Less Adjustments (explain in detail)

$

Total Taxable Premiums and Fees (must agree with SFN 4824)

$

Tax Liability (must agree to SFN 4824)

$

Instructions:

1. Complete and file this form by April 1st of each year for the preceding calendar year.

2.

Form SFN 4824 must be completed and attached to this form along with payment of the premium tax.

All fees and assessments are subject to tax. Include all fees in the figures reported on this form.

3.

4.

Include all policies with an effective date within the calendar year for which the report is filed regardless of when the premium is collected.

5.

For policies covering risks located only in North Dakota, the rate is 1 and 3/4 percent and is calculated on gross amount of premium and

all assessments and policy fees. Where the insurance covers properties, risks or exposures located or to be performed both in and out of

this state, and the policy effective date is between Jan. 1, 2011 and April 18, 2011, the tax payable must be computed upon the portion of

the premium that is properly allocable to the risks or exposures located in this state.Where the insurance covers properties, risks or

exposures located or to be performed both in and out of this state, and the policy effective date is between April 19, 2011 and Dec. 31,

2011, the tax payable must be computed based on:

l

An amount equal to one and three-fourths percent on that portion of the gross premiums allocated to this state; plus

l

An amount equal to the portion of the premiums allocated to other states or territories on the basis of the tax rates and fees

applicable to other properties, risks, or exposures located or to be performed outside of this state; less

l

The amount of gross premiums allocated to this state and returned to the insured.

6.

Send form and tax to: North Dakota Insurance Department, 600 E. Boulevard Avenue Dept. 401, Bismarck, ND 58505-0320. Make

check payable to North Dakota Insurance Department.

Producers can also submit tax filings electronically through OPTins (Online Premium Tax for Insurance), a product of the

NAIC. Contact OPTins at or 816.783.8787 to implement OPTins at your company. Visit https://eapps.

for more information. Failure to make and file the required annual report or to pay the required taxes

when due may result in a fine of $25 per day for each day of the delinquency.

I declare under the penalties provided by law that to the best of my knowledge this is a true, complete, and correct return.

Signature:

Date:

1

1