Instructions For Form Ex-2003 - Multnomah County Business Income Tax Program City Of Portland Business License Program

ADVERTISEMENT

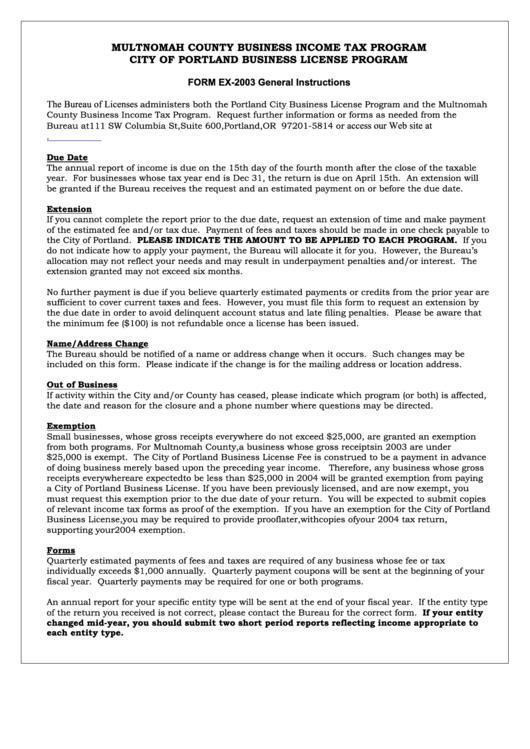

MULTNOMAH COUNTY BUSINESS INCOME TAX PROGRAM

CITY OF PORTLAND BUSINESS LICENSE PROGRAM

FORM EX-2003 General Instructions

The Bureau of Licenses

administers both the Portland City Business License Program and the Multnomah

County Business Income Tax Program. Request further information or forms as needed from the

Bureau at 111 SW Columbia St, Suite 600, Portland, OR 97201-5814 or

access our Web site at

.

Due Date

The annual report of income is due on the 15th day of the fourth month after the close of the taxable

year. For businesses whose tax year end is Dec 31, the return is due on April 15th. An extension will

be granted if the Bureau receives the request and an estimated payment on or before the due date.

Extension

If you cannot complete the report prior to the due date, request an extension of time and make payment

of the estimated fee and/or tax due. Payment of fees and taxes should be made in one check payable to

the City of Portland. PLEASE INDICATE THE AMOUNT TO BE APPLIED TO EACH PROGRAM. If you

do not indicate how to apply your payment, the Bureau will allocate it for you. However, the Bureau’s

allocation may not reflect your needs and may result in underpayment penalties and/or interest. The

extension granted may not exceed six months.

No further payment is due if you believe quarterly estimated payments or credits from the prior year are

sufficient to cover current taxes and fees. However, you must file this form to request an extension by

the due date in order to avoid delinquent account status and late filing penalties. Please be aware that

the minimum fee ($100) is not refundable once a license has been issued.

Name/Address Change

The Bureau should be notified of a name or address change when it occurs. Such changes may be

included on this form. Please indicate if the change is for the mailing address or location address.

Out of Business

If activity within the City and/or County has ceased, please indicate which program (or both) is affected,

the date and reason for the closure and a phone number where questions may be directed.

Exemption

Small businesses, whose gross receipts everywhere do not exceed $25,000, are granted an exemption

from both programs. For Multnomah County, a business whose gross receipts in 2003 are under

$25,000 is exempt. The City of Portland Business License Fee is construed to be a payment in advance

of doing business merely based upon the preceding year income. Therefore, any business whose gross

receipts everywhere are expected to be less than $25,000 in 2004 will be granted exemption from paying

a City of Portland Business License. If you have been previously licensed, and are now exempt, you

must request this exemption prior to the due date of your return. You will be expected to submit copies

of relevant income tax forms as proof of the exemption. If you have an exemption for the City of Portland

Business License, you may be required to provide proof later, with copies of your 2004 tax return,

supporting your 2004 exemption.

Forms

Quarterly estimated payments of fees and taxes are required of any business whose fee or tax

individually exceeds $1,000 annually. Quarterly payment coupons will be sent at the beginning of your

fiscal year. Quarterly payments may be required for one or both programs.

An annual report for your specific entity type will be sent at the end of your fiscal year. If the entity type

of the return you received is not correct, please contact the Bureau for the correct form. If your entity

changed mid-year, you should submit two short period reports reflecting income appropriate to

each entity type.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1