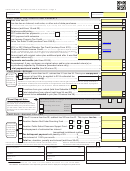

2013 Form 511 - Resident Income Tax Return - Page 3

NOTE: Enclose this page ONLY if you have an amount shown on a schedule.

Name(s) shown

Your Social

on Form 511:

Security Number:

Oklahoma Subtractions

Schedule 511-A

See instructions for details on

qualifications and required enclosures.

00

Interest on U.S. government obligations ......................................................................

BACK TO PAGE 1

1

1

00

Social Security benefits taxed on your Federal Form 1040 or 1040A ..........................

2

2

00

Federal civil service retirement in lieu of social security ...............................................

3

3

Retirement Claim Number: Taxpayer

Spouse

00

Military Retirement

............................................................

(see instructions for limitation)

4

4

00

Oklahoma government or Federal civil service retirement

....

(see instructions for limitation)

5

5

00

Other retirement income ...............................................................................................

6

6

00

U.S. Railroad Retirement Board benefits .....................................................................

7

7

00

Oklahoma depletion......................................................................................................

8

8

00

Oklahoma net operating loss .................................Loss Year(s)

..

9

9

00

Exempt tribal income ....................................................................................................

10

10

00

Gains from the sale of exempt government obligations ...............................................

11

11

00

Oklahoma Capital Gain Deduction (enclose Form 561) ...............................................

12

12

00

Miscellaneous: Other subtractions (enter number in box for type of deduction) .

13

CLICK HERE TO SELECT TYPE OF DEDUCTION

13

00

Total subtractions (add lines 1-13, enter total here and on line 2 of Form 511) .........

14

14

Oklahoma Additions

Schedule 511-B

See instructions for details on

qualifications and required enclosures.

00

State and municipal bond interest ...............................................................................

BACK TO PAGE 1

1

1

00

Out-of-state losses (describe ___________________________ )

2

Enter as a positive number .

2

00

Lump sum distributions (not included in your Federal Adjusted Gross Income) ........

3

3

00

Federal net operating loss -

..........................................................

4

Enter as a positive number

4

00

Recapture of depletion claimed on a lease bonus or add back of excess Federal depletion .....

5

5

00

Expenses incurred to provide child care programs .....................................................

6

6

00

Recapture of Contributions to Oklahoma 529 College Savings Plan and OklahomaDream 529 Account(s) ..

7

7

00

Miscellaneous: Other additions (enter number in box for type of addition) .......

8

8

CLICK HERE TO SELECT TYPE OF ADDITION

00

Total additions (add lines 1-8, enter total here and on line 6 of Form 511) ...............

9

9

Oklahoma Adjustments

Schedule 511-C

See instructions for details on

qualifications and required enclosures.

00

Military pay exclusion - Active Duty, Reserve and National Guard

...

1

(not retirement income)

1

00

Qualifying disability deduction .....................................................................................

BACK TO PAGE 1

2

2

Political contributions (limited to $100 [$200 for joint return]) ......................................

00

3

3

Interest qualifying for exclusion (limited to $100 [$200 for joint return]) .....................

00

4

4

00

Qualified adoption expense .........................................................................................

5

5

00

Contributions to Oklahoma 529 College Savings Plan and OklahomaDream 529 Account(s) ..

6

6

00

Miscellaneous: Other adjustments (enter number in box for type of deduction)

CLICK HERE TO SELECT TYPE OF DEDUCTION

7

7

Total adjustments (add lines 1-7, enter total here and on line 8 of Form 511) ..........

00

8

8

1

1 2

2 3

3 4

4 5

5