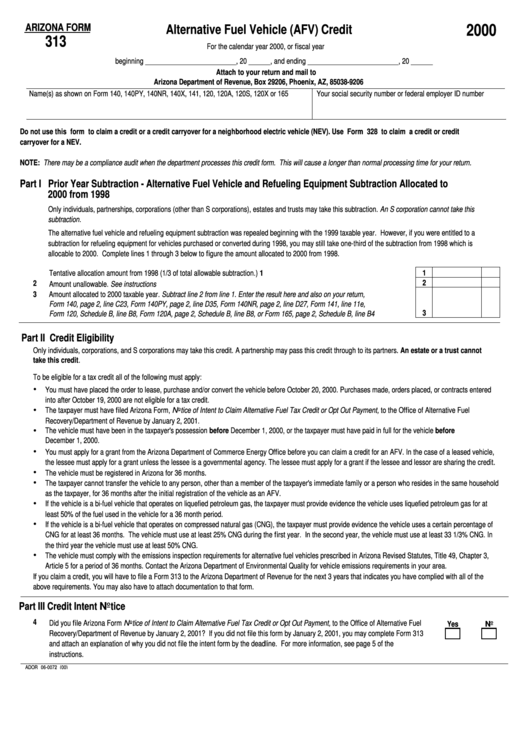

Form 313 - Alternative Fuel Vehicle (Afv) Credit - 2000

ADVERTISEMENT

2000

ARIZONA FORM

Alternative Fuel Vehicle (AFV) Credit

313

For the calendar year 2000, or fiscal year

beginning _________________________, 20 ______, and ending _________________________, 20 ______

Attach to your return and mail to

Arizona Department of Revenue, P.O. Box 29206, Phoenix, AZ, 85038-9206

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 141, 120, 120A, 120S, 120X or 165

Your social security number or federal employer ID number

Do not use this form to claim a credit or a credit carryover for a neighborhood electric vehicle (NEV). Use Form 328 to claim a credit or credit

carryover for a NEV.

NOTE: There may be a compliance audit when the department processes this credit form. This will cause a longer than normal processing time for your return.

Part I Prior Year Subtraction - Alternative Fuel Vehicle and Refueling Equipment Subtraction Allocated to

2000 from 1998

Only individuals, partnerships, corporations (other than S corporations), estates and trusts may take this subtraction. An S corporation cannot take this

subtraction.

The alternative fuel vehicle and refueling equipment subtraction was repealed beginning with the 1999 taxable year. However, if you were entitled to a

subtraction for refueling equipment for vehicles purchased or converted during 1998, you may still take one-third of the subtraction from 1998 which is

allocable to 2000. Complete lines 1 through 3 below to figure the amount allocated to 2000 from 1998.

1

1

Tentative allocation amount from 1998 (1/3 of total allowable subtraction.) ......................................................................................

2

2

Amount unallowable. See instructions ...............................................................................................................................................

3

Amount allocated to 2000 taxable year. Subtract line 2 from line 1. Enter the result here and also on your return,

Form 140, page 2, line C23, Form 140PY, page 2, line D35, Form 140NR, page 2, line D27, Form 141, line 11e,

3

Form 120, Schedule B, line B8, Form 120A, page 2, Schedule B, line B8, or Form 165, page 2, Schedule B, line B4 ...................

Part II Credit Eligibility

Only individuals, corporations, and S corporations may take this credit. A partnership may pass this credit through to its partners. An estate or a trust cannot

take this credit.

To be eligible for a tax credit all of the following must apply:

Ÿ

You must have placed the order to lease, purchase and/or convert the vehicle before October 20, 2000. Purchases made, orders placed, or contracts entered

into after October 19, 2000 are not eligible for a tax credit.

Ÿ

The taxpayer must have filed Arizona Form, Notice of Intent to Claim Alternative Fuel Tax Credit or Opt Out Payment, to the Office of Alternative Fuel

Recovery/Department of Revenue by January 2, 2001.

The vehicle must have been in the taxpayer's possession before December 1, 2000, or the taxpayer must have paid in full for the vehicle before

Ÿ

December 1, 2000.

Ÿ

You must apply for a grant from the Arizona Department of Commerce Energy Office before you can claim a credit for an AFV. In the case of a leased vehicle,

the lessee must apply for a grant unless the lessee is a governmental agency. The lessee must apply for a grant if the lessee and lessor are sharing the credit.

Ÿ

The vehicle must be registered in Arizona for 36 months.

Ÿ

The taxpayer cannot transfer the vehicle to any person, other than a member of the taxpayer's immediate family or a person who resides in the same household

as the taxpayer, for 36 months after the initial registration of the vehicle as an AFV.

Ÿ

If the vehicle is a bi-fuel vehicle that operates on liquefied petroleum gas, the taxpayer must provide evidence the vehicle uses liquefied petroleum gas for at

least 50% of the fuel used in the vehicle for a 36 month period.

Ÿ

If the vehicle is a bi-fuel vehicle that operates on compressed natural gas (CNG), the taxpayer must provide evidence the vehicle uses a certain percentage of

CNG for at least 36 months. The vehicle must use at least 25% CNG during the first year. In the second year, the vehicle must use at least 33 1/3% CNG. In

the third year the vehicle must use at least 50% CNG.

Ÿ

The vehicle must comply with the emissions inspection requirements for alternative fuel vehicles prescribed in Arizona Revised Statutes, Title 49, Chapter 3,

Article 5 for a period of 36 months. Contact the Arizona Department of Environmental Quality for vehicle emissions requirements in your area.

If you claim a credit, you will have to file a Form 313 to the Arizona Department of Revenue for the next 3 years that indicates you have complied with all of the

above requirements. You may also have to attach documentation to that form.

Part III Credit Intent Notice

4

Did you file Arizona Form Notice of Intent to Claim Alternative Fuel Tax Credit or Opt Out Payment, to the Office of Alternative Fuel

Yes

No

Recovery/Department of Revenue by January 2, 2001? If you did not file this form by January 2, 2001, you may complete Form 313

and attach an explanation of why you did not file the intent form by the deadline. For more information, see page 5 of the

instructions.

ADOR 06-0072 (00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6