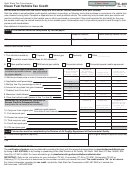

Arizona Form 313 - 2000 Alternative Fuel Vehicle (Afv) Credit

ADVERTISEMENT

Arizona Form

2000 Alternative Fuel Vehicle (AFV) Credit

313

than a member of the taxpayer’s immediate family or a person

NOTE: There may be a compliance audit when the department

who resides in the same household as the taxpayer, for 36

processes this credit form. This will cause a longer than normal

months after the initial registration of the vehicle as an AFV.

processing time for your return.

•

Phone Numbers

The vehicle must be registered in Arizona for 36 months.

•

If the vehicle is a bi-fuel vehicle that operates on liquefied

If you have questions, please call one of the following help numbers:

petroleum gas, the taxpayer must provide evidence that the

vehicle uses liquefied petroleum gas for at least 50% of the fuel

Phoenix

(602) 255-3381

used in the vehicle for 36 months.

Nationwide, toll-free

(800) 352-4090

Form orders

(602) 542-4260

•

If the vehicle is a bi-fuel vehicle that operates on compressed

Forms by Fax

(602) 542-3756

natural gas (CNG), the taxpayer must provide evidence that the

Recorded Tax Information

vehicle uses a certain percent of CNG for a period of 36 months.

Phoenix

(602) 542-1991

For the first year, the vehicle must use CNG for at least 25% of

Other Arizona areas, toll-free

(800) 845-8192

the fuel used in the vehicle. In the second year, the vehicle must

Hearing impaired TDD user

use CNG for at least 33 1/3% of the fuel used in the vehicle. In

Phoenix

(602) 542-4021

the third year, the vehicle must use CNG for at least 50% of the

Other Arizona areas, toll-free

(800) 397-0256

fuel used in the vehicle.

•

You may also visit our web site at:

The vehicle must comply with the emissions inspection

requirements for alternative fuel vehicles prescribed in Arizona

Revised Statutes, Title 49, Chapter 3, Article 5.

Credit Provisions

Credit Recapture

For taxable years beginning from and after December 31, 1999,

Arizona law allows an alternative fuel vehicle (AFV) credit for the

The department is required to disallow the credit or to recapture the

following.

credit if any of the following occur:

•

•

For purchasing or leasing a new AFV during the taxable year for

The taxpayer transfers the vehicle to any person, other than a

use in Arizona.

member of the taxpayer’s immediate family or a person who

•

resides in the same household as the taxpayer, within 36 months

For purchasing or leasing a used AFV during the taxable

after the initial registration of the vehicle as an AFV. The

year for use in Arizona, providing the used vehicle was

recapture will not apply if the vehicle is transferred because the

purchased or leased prior to July 1, 2000.

vehicle is demolished or if the taxpayer dies before the end of the

•

For incurring expenses during the taxable year for converting a

36-month period.

new or a used conventionally fueled vehicle to operate on

•

The vehicle is registered in Arizona for less than 36 months.

alternative fuel for use in Arizona.

•

If a bi-fuel vehicle that operates on liquefied petroleum gas does

Eligibility Requirements

not use liquefied petroleum gas for at least 50% of the fuel used

in the vehicle for 36 months.

To be eligible for an AFV credit, all of the following must apply:

•

If a bi-fuel vehicle that operates on CNG does not use CNG for

•

You must have placed the order to lease, purchase and/or

at least 25% of the fuel used in the vehicle for the first year, at

convert the vehicle before October 20, 2000. Purchases made,

least 33 1/3% in the second year, and at least 50% in the third

orders placed, or contracts entered into after October 19, 2000

year.

are not eligible for a credit.

•

•

The vehicle fails to comply with the emissions inspection

You must have filed Arizona Form, Notice of Intent to Claim

requirements for alternative fuel vehicles prescribed in Arizona

Alternative Fuel Credit or Opt Out Payment , to the Office of

Revised Statutes, Title 49, Chapter 3, Article 5.

Alternative Fuel Recovery/Department of Revenue by January 2,

2001. If you file this form by mail, this form must have been

If any of the above occurs, the credit recapture will be calculated as

postmarked by January 2, 2001. You may also use certain

follows:

private delivery services designated by the IRS to meet the

•

If the date of the event that causes the recapture is within the

“timely mailing as timely filed” rule.

first full year after the vehicle is placed in service, 100%.

•

The vehicle must be in the taxpayer’s possession before

•

If the date of the event that causes the recapture is within the

December 1, 2000, or the taxpayer must have paid in full for the

second full year after the vehicle is placed in service, 66 2/3%.

vehicle before December 1, 2000.

•

•

You must apply for a grant from the Arizona Department of

If the date of the event that causes the recapture is within the

Commerce Energy Office to be eligible for a credit for an AFV.

third full year after the vehicle is placed in service, 33 1/3%.

In the case of a leased vehicle, the lessee must apply for a grant

Opt Out

in order for the lessee and the lessor to be eligible to share the

credit, unless the lessee is a governmental agency.

If a taxpayer does not want to comply with the possession,

•

The taxpayer cannot transfer the vehicle to any person, other

registration, emission, and/or fuel use requirements, the taxpayer may

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7