Form Fr-500 - Combined Registration Application For Business Page 2

ADVERTISEMENT

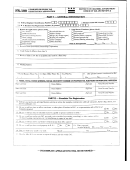

PART III — Employer’s DC Withholding Tax Registration

23. Estimated total number of employees __________

24. Number of DC resident employees subject to DC

Withholding Tax: _______________

25a. Date when you began to employ DC resident(s) ____/____/____

26. Estimate of amount of DC tax to be withheld monthly from

MM DD YYYY

DC resident employees:

25b. Date when you began or when you expect to begin

27. Will you have employee(s) working in DC?

to withhold DC tax from resident employees ____/____/____

MM DD YYYY

28. Withholding from retirement accounts or plans

Yes

No

PART IV — Sales and Use Tax Registration

29. Check applicable box(es) below

Reporting Sales Tax on retail sales or rentals.

Reporting Use Tax on items purchased tax free inside/outside DC

Purchasing in DC items for resale outside DC (Attach photocopy of state/county sales tax registration.)

Purchasing in DC cigarettes for resale outside DC (Attach photocopy of state/county cigarette/tobacco license.)

Making no taxable sales and tax is paid to vendors on all taxable purchases.

Special Events

Making exempt sales where a Certificate of Resale is issued.

Street Vendor and Mobile Food Services.

Specialized Sales

30. Date when sales/use began in DC (MM/DD/YYYY) ______/______/______ or date expected to begin.

31. If you have more than one place of business where you collect taxes on sales

in DC, please attach a statement listing the additional places of business.

PART V — Personal Property Tax Registration

Describe the type of Personal Property at each location (ex. furniture, fixtures, machinery equipment and supplies), used for business purposes.

PART VI — Ballpark Fee Registration

Are annual gross receipts greater than $5 million?

Yes

No

Begin date (MMDDYYYY) __ /___/____

End date (MMDDYYYY) ___/___/____

PART VII — Tobacco Products Excise Tax Registration

Yes

No

Begin date (MMDDYYYY) ____/____/________

End date (MMDDYYYY) ____/____/________

PART VIII, Section 1 — Nursing Facility/Registration

Yes

No

Begin date (MMDDYYYY) ____/____/________

End date (MMDDYYYY) ____/____/________

PART VIII, Section 2 — Intermediate Care Facility for Persons with Intellectual or Developmental Disabilities (ICF-IDD) Tax Registration

Yes

No

Begin date (MMDDYYYY) ____/____/________

End date (MMDDYYYY) ____/____/________

PART VIII, Section 3 — Hospital Revenue Assessment

Yes

No

Begin date (MMDDYYYY) ____/____/________

End date (MMDDYYYY) ____/____/________

PART VIII, Section 4 — Hospital Provider Fee

Yes

No

Begin date (MMDDYYYY) ____/____/________

End date (MMDDYYYY) ____/____/________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3