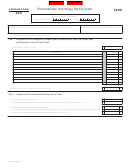

Arizona Form 305 Draft - Environmental Technology Facility Credit - 2010 Page 3

ADVERTISEMENT

Name:

TIN:

AZ Form 305 (2010)

Page 3 of 3

Part VI Available Credit Carryover

(a)

(b)

(c)

(d)

Available carryover -

Original credit

Amount

subtract column

Taxable year

amount

previously used

(c) from column (b)

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

Total available

39

carryover

Part VII Total Available Credit

40 Current year’s credit. Individuals, corporations, or S corporations - enter the amount from Part I, line 3, column (b).

S corporation shareholders - enter the amount from Part III, line 12.

Partners of a partnership - enter the amount from Part IV, line 16................................................................................................... 40

00

41 Available credit carryover - from Part VI, line 39, column (d) ........................................................................................................... 41

00

42 Total available credit. Add line 40 and line 41. Corporations and S corporations - enter total here and on

Form 300, Part I, line 3. Individuals - enter total here and on Form 301, Part I, line 3 ................................................................... 42

00

ADOR 10132 (10)

DRAFT 10/5/09, 12:00 p.m.

DRAFT 10/5/09, 12:00 p.m.

Previous ADOR 91-0052

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3